The Canadian stock market has been one of the worst performing markets in the world in the past decade according to a recent article in The Globe and Mail. One of the main reasons from the poor performance of Canadian stocks relative to their American peers is the global crash in commodity prices. From the article:

The stock-market correction was made in America, then promptly exported to Canada. Overheated U.S. stocks were the starting point for a week of unnerving market tumult, which quickly turned into an indiscriminate global sell-off sparing no major market.

Canadian stocks were hardly due for a major slump, but were punished regardless in a return to an unwelcome but familiar form.

Already badly trailing the rest of the world, the latest setback in domestic equities has dragged the S&P/TSX composite index into negative territory since the precrisis peak nearly 10 years ago.

-Not counting dividends, the main Canadian benchmark is now trading below its 2008 peak just prior to the onset of the global financial crisis.

As the U.S. stock market was transformed into a madhouse of volatility, the cross-border transmission of fear has dragged the S&P/TSX composite down by 5.2 per cent over the past week or so.

For Canadian investors, it has been a smoother, slightly shallower decline, as the domestic losses haven’t been quite so drastic, and the swings in U.S. benchmarks not quite so violent here.

But Canadian stocks may have been less vulnerable to a correction simply because they lagged so badly up to that point, sitting out what has been a powerful uptrend in stock prices almost everywhere but here.

Source: Dead last: As Canadian stocks lag, long-term returns prove paltry, The Globe and Mail

Many investors, including myself, may not know how much Canada has under-performed US in the past few years. So I compared the performance of S&P 500 and the TSX composite Index in different time periods.

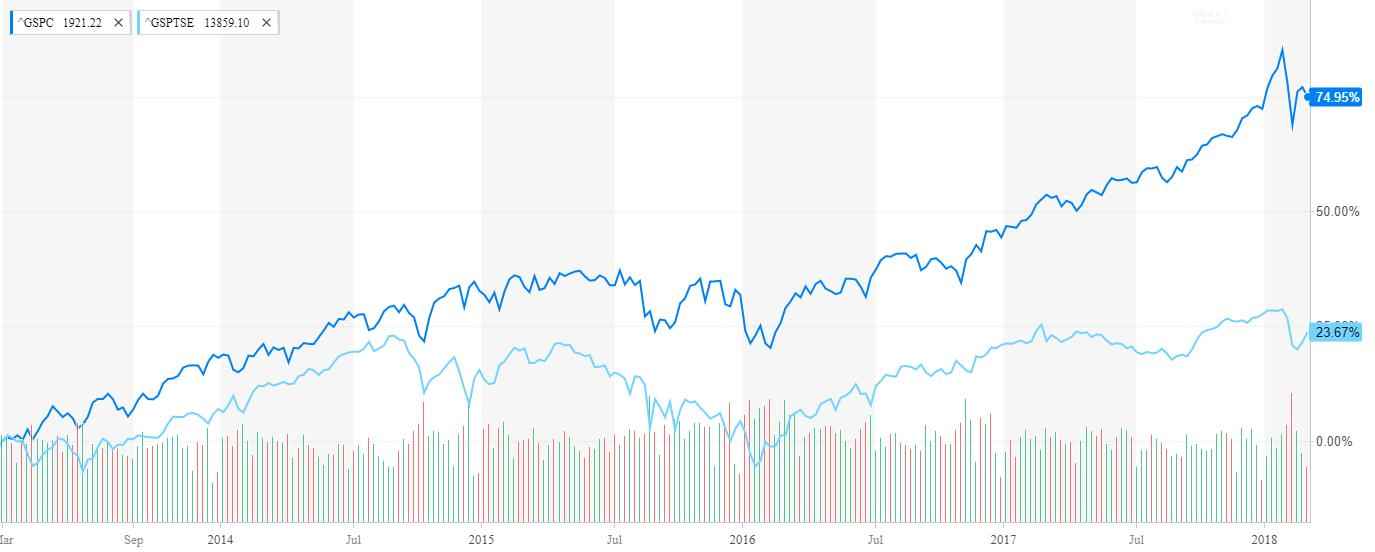

The chart below shows the performance of S&P/TSX Composite vs. S&P 500 in the past 5 years:

Click to enlarge

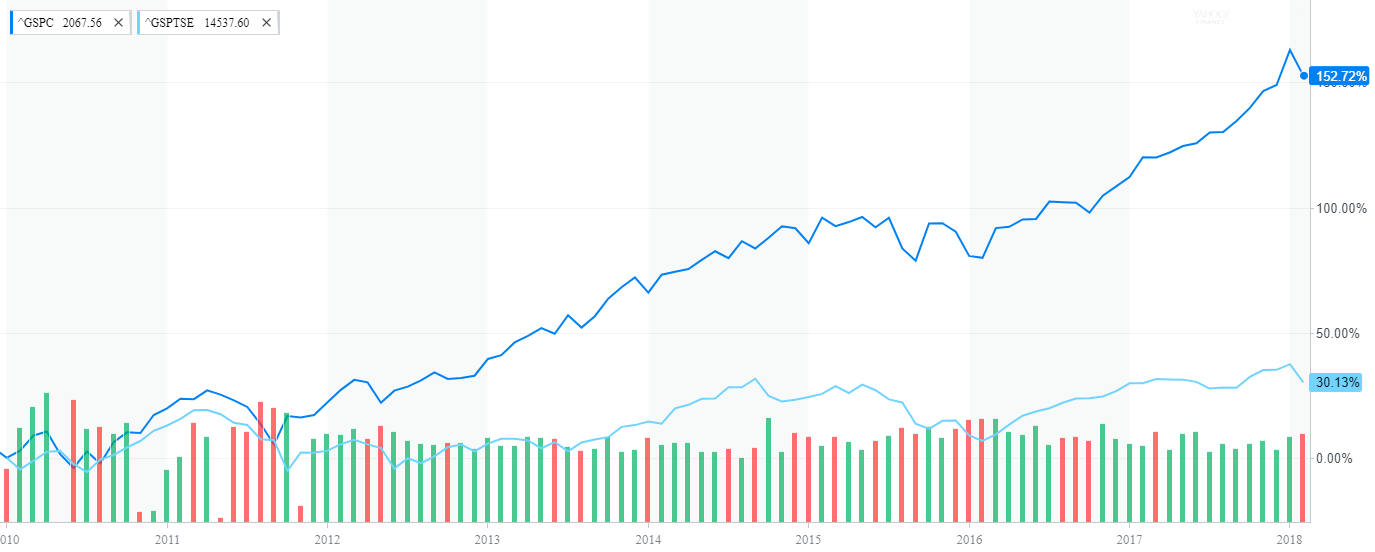

10-Year return chart:

Source: Yahoo Finance

The above charts show the magnitude of difference in returns between the markets. The takeaway for Canadian equity investors is that diversification beyond home markets is important.

Related ETFs:

Disclosure: No Positions