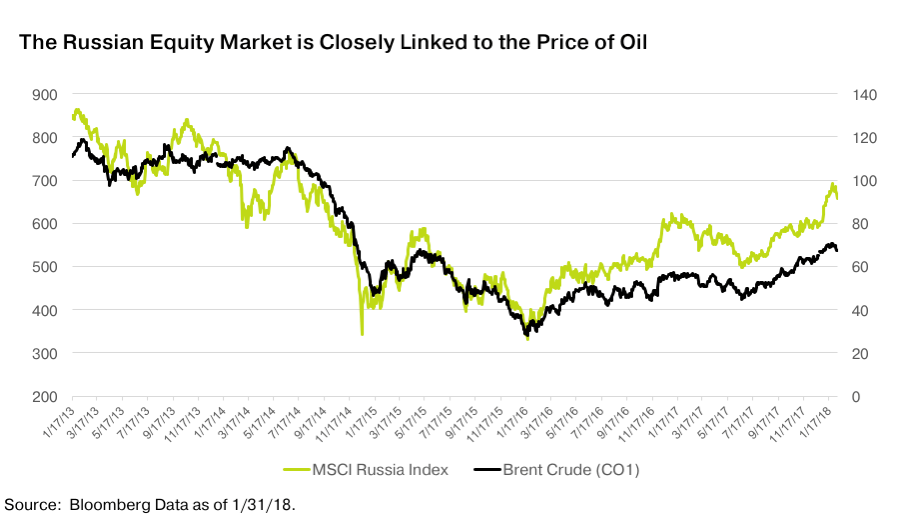

The Russian equity market is highly correlated to the price of crude oil. Since Russia is one of the largest oil producers and exporters in the world, Russian stocks perform well when oil prices are high. Conversely declining oil prices leads to lower equity prices.

The chart below shows the close relationship between Russian stock market and oil prices:

Click to enlarge

Source: Investing in Russia’s Resurgence, by Justin Leverenz , Oppenheimer Funds

From the above article:

Russia could very possibly be the best performing market in the world this year. This is not an attempt at hyperbole, but rather a recognition that a convergence of variables, partnered with extremely attractive valuations, have set the stage for the market to shine.

But it has been a long and difficult road to get to this stage. The Russian market is closely linked to the oil price (see chart), so the collapse of oil from $140+ to below $40 in 2008 marked the start of almost a decade of disappointment. In that period, Russia’s influence in the emerging market (EM) world waned. At the end of 2007, its index weighting was 10.1%, fourth highest after China, South Korea and Brazil, with a market capitalization of $1.2 trillion. Today its weighting is just 3.3%. And its capitalization is less than half of what it was 10 years ago! Since mid-2017, oil has enjoyed a renaissance, currently flirting with $70 levels, with increasing confidence that $60+ is sustainable. The ruble – which is intricately linked to crude oil prices – has stabilized, having fallen 40% since oil stumbled violently in October 2014.

The entire above-linked article is worth a read.