Investors in US equities are becoming increasingly worried about high valuations as the bull market continues to roar with nothing unable to stop it. From North Korean political tensions to US political drama such as the shutdown, the Russian investigation of manipulation of US elections, etc. stocks seem immune to fall. While investors have focused on traditional metrics such as the Shiller multiple to worry about extreme valuations, Deutsche Bank’s Luke Templeman says that the unsustainable dividend payouts of US firms is the metric that may finally tip US stocks from their relentless march upwards. In a nutshell, he states that American companies are borrowing heavily to finance their dividend payments though earnings have are not keeping up. Companies feel they have no choice other than to maintain dividend payouts in order to keep investors happy. It should be noted that unlike European firms which tend to vary dividends based on profits, US firms traditionally maintain and even increase dividends regardless of earnings.

From the article titled “US equities -the dividend shakeout” in DB’s Konzept report:

Dividends, though, do provide a warning signal. Indeed, the evidence shows that market gains in recent years have been propped up by unsustainable expectations of future dividends, and there are signs t hat 2018 could be the year.

the trend finally turns. The dividend aristocrats provide a useful illustration. These are a selection of about 50 stocks which have a strong history of paying increasing and reliable dividends. These stocks matter as they comprise about one-fifth of the total market value of the S&P 500 and their post-crisis bull run has been a significant contributor to the overall stockmarket’s return. Indeed, since the crisis, they have outperformed the S&P 500 by one-fifth.

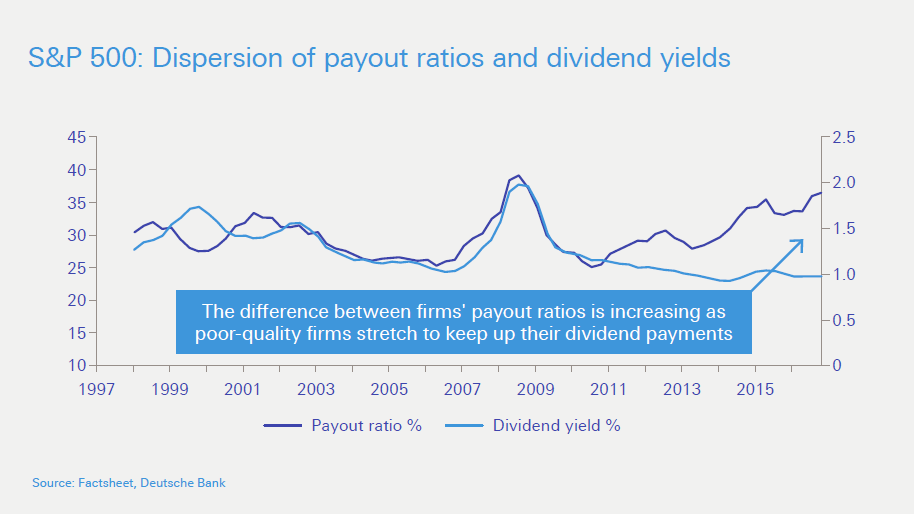

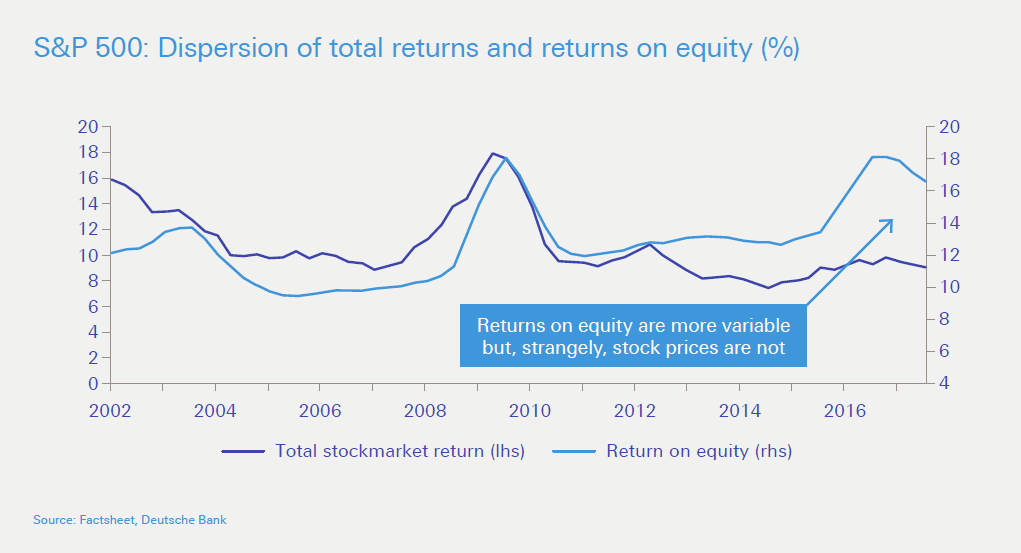

More recently, though, the aristocrats’ performance has turned. Over the last 18 months, they have underperformed by about one-quarter. One reason for this is that investors have begun to realise they have reached capacity in the amount of debt they can take on to finance both outsized dividends and share buybacks. In the decade before the crisis, the net debt of these stocks was a steady one-third of ebitda. Since then, net debt has more than tripled as a proportion of earnings. This increase in leverage to fund capital returns can only happen once yet investors valued these stocks on the basis it could persist.Another sign that investors have increasingly valued stocks based on their dividend can be found in the dividend yield of S&P 500 stocks which has been relatively constant since the financial crisis. More importantly, the difference between the dividend yields of stocks, the dispersion, has been falling and now sits at its lowest level in at least two decades. This is down 15 per cent from precrisis levels. Said a different way, market prices have become increasingly sensitive to changes in dividend payouts. Unsurprisingly, managers have paid attention and boosted them. Just before the crisis, the average company paid out one-third of its earnings as a dividend. Now it pays out a half. Furthermore, the dispersion between dividend payments has stayed low, meaning companies have paid attention to their peers and increased their dividends in unison.

The entire piece is worth a read. Investors interesting on his arguments for a potential crash in US stocks may read the full article here.