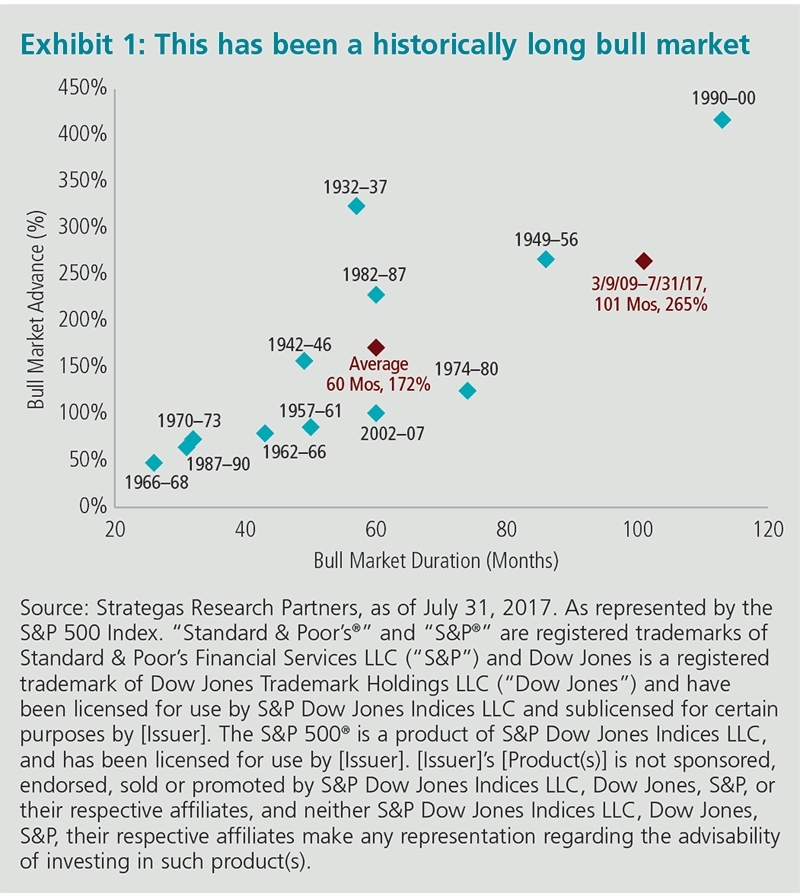

The current bull market in US stocks is one of the longest in history. Since the troughs reached in early 2009, the S&P 500 has continued to soar with mutiple records in recent weeks.The following chart shows the length and return of bull markets since 1962:

Click to enlarge

Source: When Time Is On Your Side: The Cyclical Nature of Fundamental Active Management by Michael W. Roberge, MFS, Sept 2017

Nobody knows how long the current expansion would continue. However the experts at Fidelity predict stocks may continue to run higher for some more time. From a article published last month at FE Trustnet:

Strategists at the group point out that there are a number of reasons to be negative on the outlook for equity markets from here – but there are also enough reasons to rule out an immediate correction.

For example, the S&P 500 has been hovering around the 2,400 mark for several months and it is possible to make a compelling argument for the index reaching as high as 2,700. While further expansion of valuation multiples is unlikely given how stretched they are at present, the US is seeing double-digit earnings growth that could drive stocks higher.

However, there are fewer arguments for the index moving much further past 2,700. Fidelity added: “When the market runs out of fundamental reasons to go up, then we are essentially entering bubble territory. We have already seen some remarkable price moves in some hot areas of the US stock market that look to be sentiment driven.”

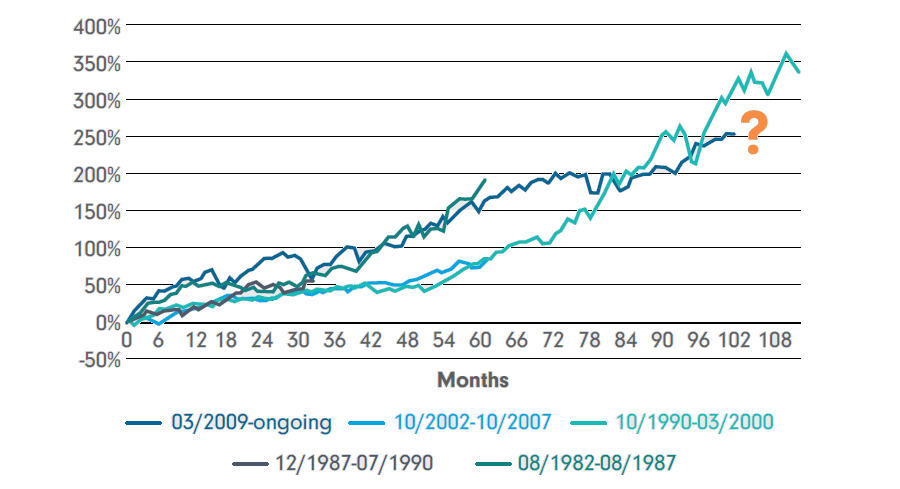

That said, history suggests the bull market could continue without significant upheaval, according to the strategists. Given that an early exit by investors could leave a lot of potential return on the table, many could be unwilling to sell up until a turning point is clear and present.

Source: “Be braver for longer”: Fidelity calls the final phase of the bull market, FE Trustnet

Trying to predict the end of the bull market is a fool’s game. So instead of worried about how long good times will last or when stocks will crash investors are wise to focus on things that are under their control. For example, having cash on hand to deploy when there is bloods on the streets is one point to remember.