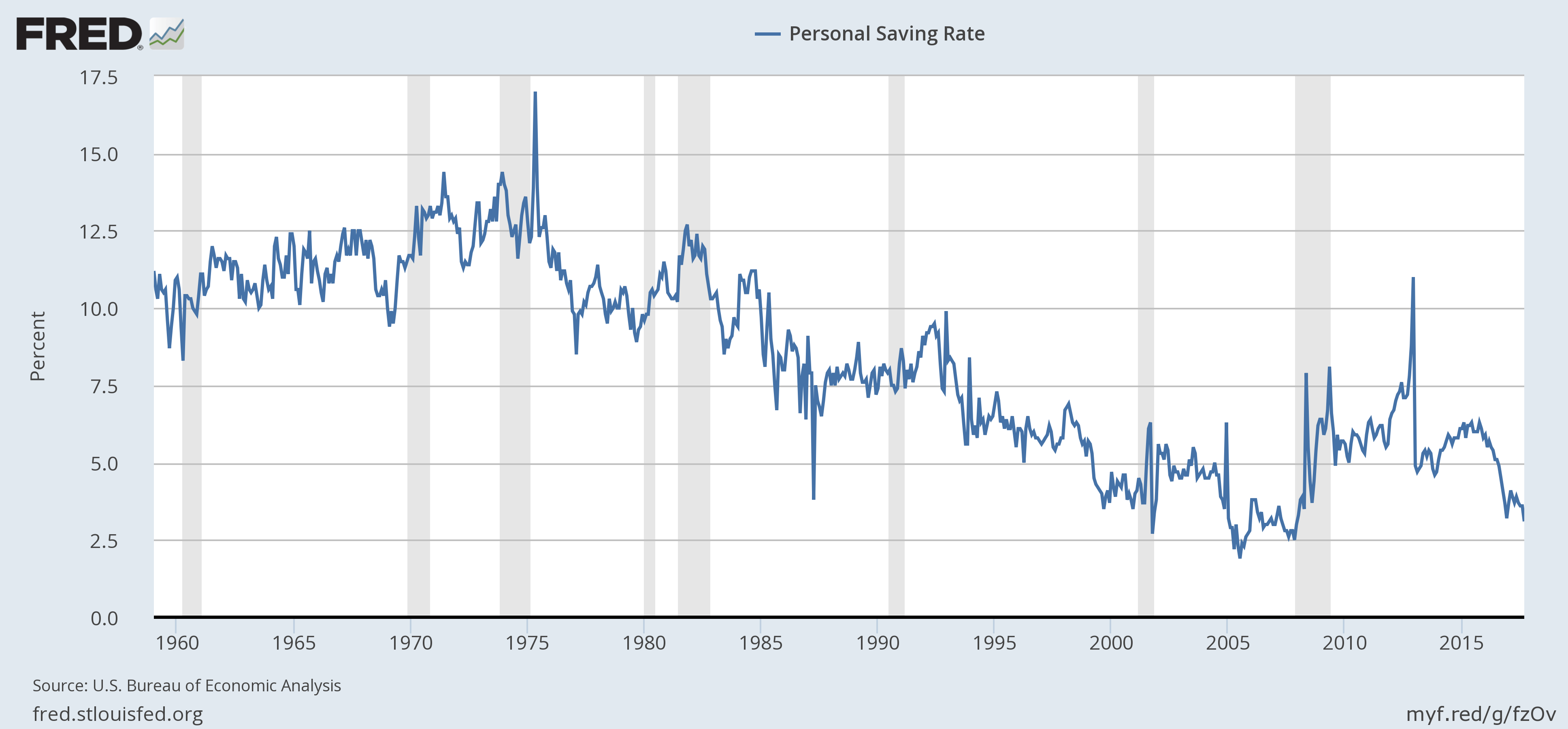

The US economy is a consumption-driven economy. Hence American consumers traditionally tend to spend than save. The personal saving rate grew after the global financial crisis of 2008-09 and reached a peak of 11% in Dec, 2012. But since then a growing economing and falling unemployemnt have led to a decrease in the saving rate again. According to a journal article today the persoanl saving rate has reached a 10-year low of 3.1% in September according to date by the St.Louis Federal Reserve.

The chart below shows the long-term US Personal Saving Rate:

Click to enlarge

Source: St.Louis Fed

Wages for workers have remained mostly stagnant for many years now but consumer debt of all types have shot up as consumers take advantage of cheap credit available. Declining saving rate is a cause of worry for investors as consumers do not have a cushion to survive should the economy turn South again.