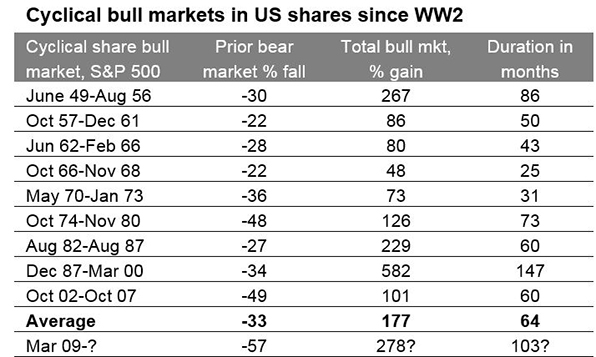

The Dow Jones crossed 23,000 for the first time today. The S&P 500 has also made record gains since the Global Financial Crisis(GFC) of 2008-09. In fact, the current cyclical bull market is the second strongest in terms of returns and is also the second longest since World War II according to an article by Shane Oliver at AMP Capital.

The following table shows the many cyclical bull markets in US stocks since World War II:

Click to enlarge

Source: Where are we in the global investment cycle and what’s the risk of a 1987 style crash? by Shane Oliver, AMP Capital

Shane used the definition that “a cyclical bull market is a rising trend in shares that ends when shares have a 20% or more fall (ie, a cyclical bear market). Source: Bloomberg, AMP Capital.”