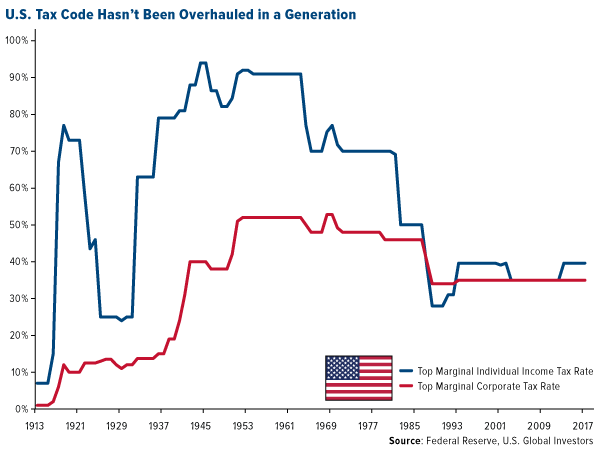

The graph below shows the US top marginal individual income tax rate against top marginal corporate tax rates. The tax rates haven’t changed in over 30 years.

The current administration is planning to reduce the top rate for individuals from 39.6% to 35% and for corporations from 35% to 20%.

Click to enlarge

Source: This Could Be a No-Brainer Gold Buying Opportunity by Frank Homes, US Global Investors

The income tax rate for individuals have always been higher than for corporations for the most part.