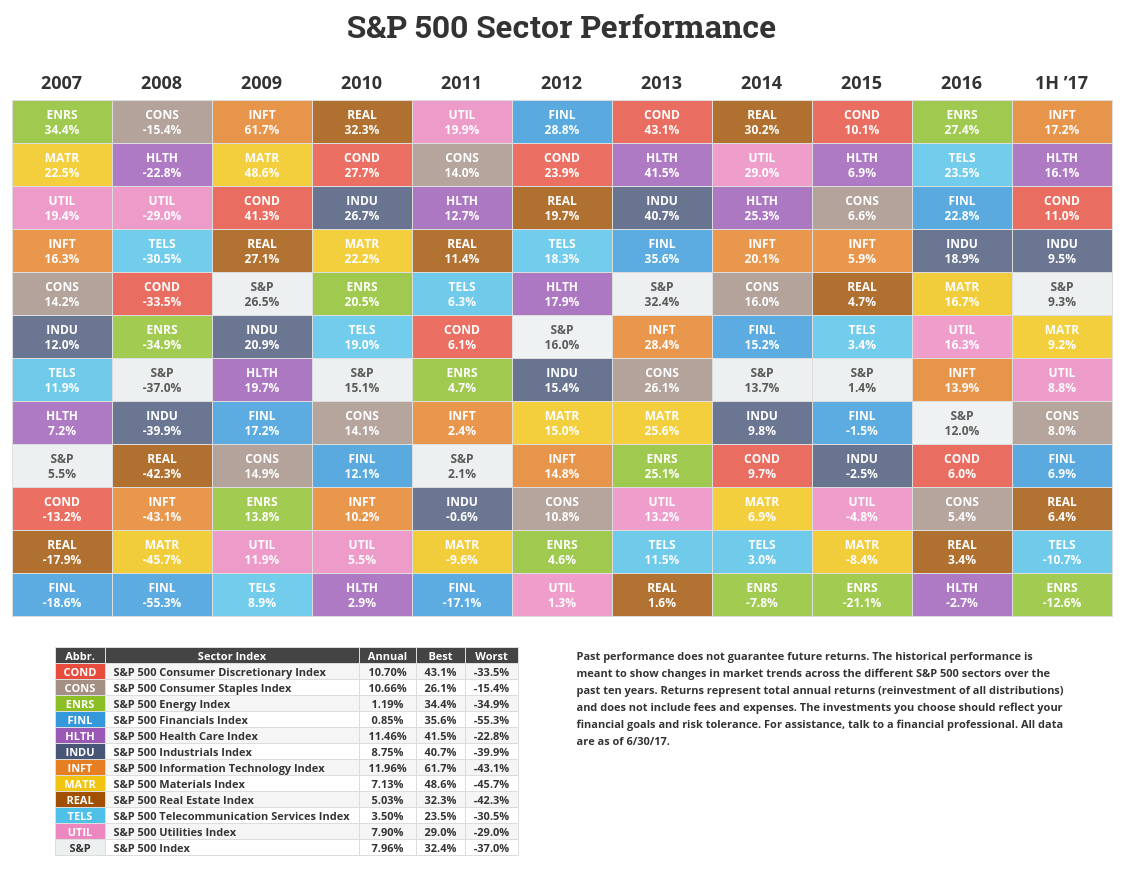

Diversification is the simple and easy way to avoid major disasters and achieve one’s long-term goal in equity investment. The following chart vividly makes this point clear.At the height of the global financial crisis, the S&P 500 fell 37% in 2008 but the consumer staples index declined by only 15%. Similarly no index has been the consistent top performer year after year. So investors have to diversify their assets across sectors if holding individual stocks or ETFs or go with a S&P 500 ETF that gives exposure to all the sectors.

Click to enlarge

Source: Novel Investor

Related ETFs:

- SPDR S&P 500 ETF (SPY)

Disclosure: No Positions