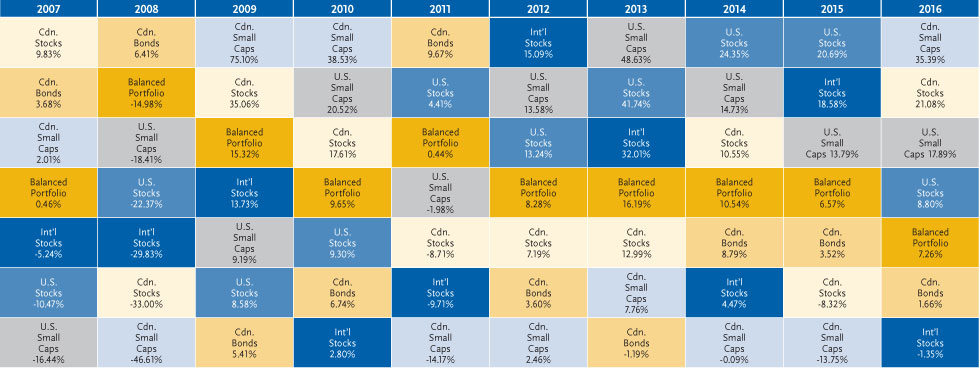

One of the simple and easy ways to reduce risks with investing in equity markets is to diversify one’s assets across various asset types, countries, regions, etc. The following chart shows the unpredictability of market returns one year after another:

Click to enlarge

Source: AGF Investment Operations, December 31, 2016. Canadian Stocks represented by S&P/TSX Composite Total Return Index, U.S. Stocks – S&P 500 Total Return Index (C$), International Stocks – MSCI EAFE Index (C$), Canadian Bonds – FTSE TMX Canada Universe Bond Index, U.S. Small Caps – Russell 2000 Index (C$), Canadian Small Caps – BMO Nesbitt Burns Canadian Small Cap Index. Balanced Portfolio made up of 20% Cdn. Stocks / 20% International Stocks / 15% U.S. Stocks / 40% Cdn. Bonds / 2.5% U.S. Small Caps / 2.5% Cdn. Small Caps.

The information provided is for illustrative purposes only and is not meant to provide investment advice. You cannot invest directly in an index. Calendar years returns in Canadian dollars.

Source: AGF Management Limited