One of the important investment concepts that investors have to always remember is the futility of trying to time the market. It is never a wise strategy to time the market – which simply means selling out at market tops and buying back at market lows and repeating the process over and over. Since this process involves predicting the future it is always destined to fail. There is no way to determine the market peak as well as market troughs. Hence instead of trying to time the markets investors are better off just being in the market with a long-term horizon. Or to put it another way time in the market is more important than timing the market. During the Global Financial Crisis(GFC) many investors lost out when they sold out at the peak of the crisis and failed to get back in when markets roared back strongly.

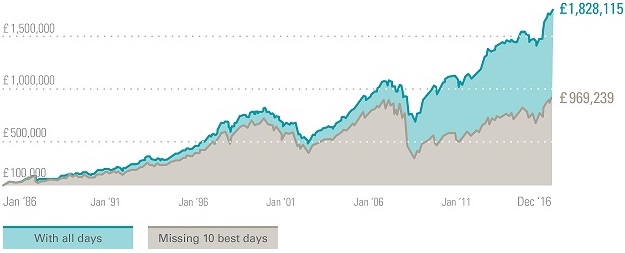

I have written articles before in timing the market using the example of US markets. In a recent article, James Norton, senior investment planner at Vanguard UK discussed about the importance of time in the market.The chart below shows that the return on the FTSE All-Share Index was cut in half when an investor misses the 10 best days of the market. The FTSE All-Share Index represents 98-99% of UK market capitalization and is the aggregation of the FTSE 100, FTSE 250 and FTSE Small Cap Indexes. So its a better representation of the British equity market than the FTSE 100.

Click to enlarge

Source: Time in the markets, not timing the market, Vanguard UK

Related ETFs:

- iShares MSCI United Kingdom Index (EWU)

Disclosure: No Positions