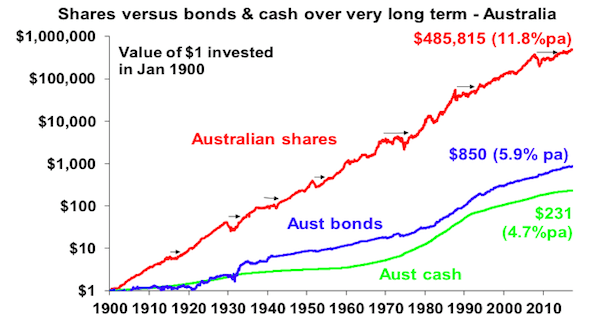

Albert Einstein said “Compound interest is the eighth wonder of the world”. Compounding of interest over many years will lead to multiplication of the original principal or capital many times. The following example shows the power of compounding for various Australian asset classes:

Click to enlarge

Source: Five great charts on investing, AMP Capital

From the above article:

The chart shows the value of $1 invested in various Australian assets in 1900 allowing for the reinvestment of dividends and interest along the way. That $1 would have grown to $231 if invested in cash, to $850 if invested in bonds and to $485,815 if invested in shares. While the average return since 1900 is only double that in shares relative to bonds, the huge difference between the two at the end owes to the impact of compounding or earning returns on top of returns. So any interest or return earned in one period is added to the original investment so that it all earns a return in the next period. And so on.

Similar to most other developed markets, stocks beat cash and bonds in Australia also from a return perspective. It is unlikely that one would stocks for such a long period of time such as over 100 years though. Most people invest or save for a particular goal such as retirement or children’s education. Despite this point, the above chart clearly shows that investing in stocks yields a better return than cash or bonds.