Global investors fled banking stocks after the financial crisis of 2008-09. Some have totally avoided them since then due to many factors including relatively higher risks than other sectors and fear of unknowns. Banks in some countries and regions have recovered strongly since 2008-09 while others have not. For instance, the US banking sector has recovered following the crisis. But many of their peers in Europe have struggled to gain traction due to lack of bold actions on their part and dithering by politicians and regulators.

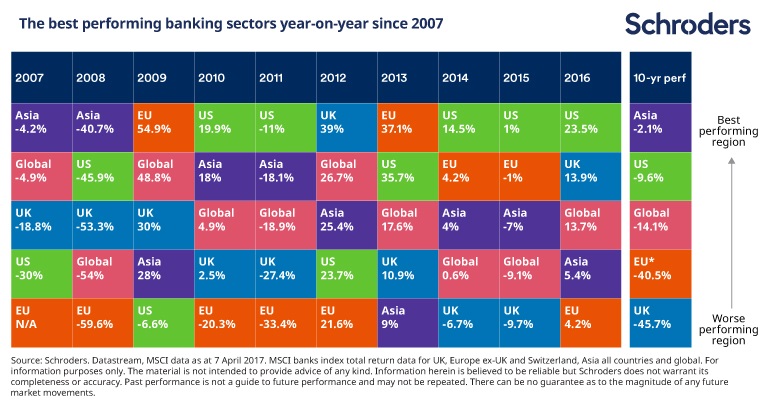

According to an article published yesterday by Schroders, in the 10 years since 2007 Asian banks are the top performers followed by US banks.UK banks have been the worst performers.From the article:

The global banking sector returned 13.7% in 2016 with dividends included, according to MSCI data. In comparison, the MSCI World index returned a more modest 8.2%.

Among banks, the biggest gains were made by the US and UK, although Asian and European banks were also significantly higher.

However, the gains have come after years of underperformance which began with the global financial crisis a decade ago. It was the trigger for a wider economic malaise and also led to a crackdown on the banking sector by regulators.

Even after 2016’s gains the MSCI world banking index was still 14.1% lower than it was 10 years ago. If you had invested $1,000 in MSCI world banking index on 31 December in 2006, your investment would be worth $859, as of 31 December 2016.

In comparison, $1,000 invested in the MSCI World Index over the same period would today stand at $1,497. Again, these are total return figures that include the payment of dividends.

Source: Is it still worth investing in bank shares? by David Brett, Investment Writer, Schroders

Key takeaways:

- American banks are in a much better shape than other developed market banks. However though some of banks’ share prices have reached their pre-crisis level, the dividend payments are still lower than before the crisis. As stronger banks improve their earnings dividends should increase as well.

- In Europe, its better to avoid British and German banks. Investors can look at banks in Spain, The Netherlands and Scandinavia. Swedish banks are particularly strong and have decent dividend yields.

- In Asia, Aussie and Singapore banks offer potential opportunities.

- Brazilian banks continue to be shaky due to the ongoing political crisis and economic malaise there. Investors can consider banks in Mexico, Peru, Chile and Colombia.