One of the easiest and simplest ways to gain exposure to emerging market equities is via an ETF. Some of the world’s top emerging market ETFs benchmark to the MSCI Emerging Markets Index offered by the index provider MSCI. In fact, according to MSCI over $1.5 Trillion in assets are benchmarked to this index.

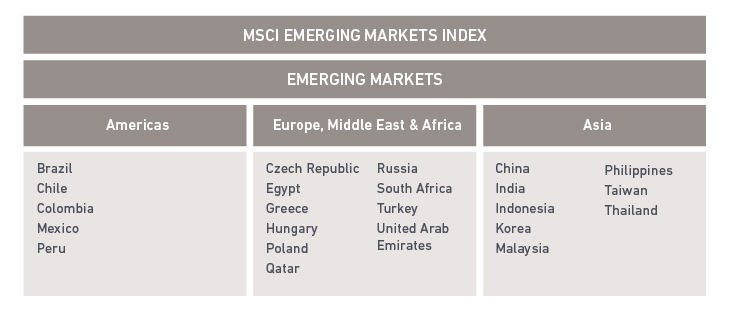

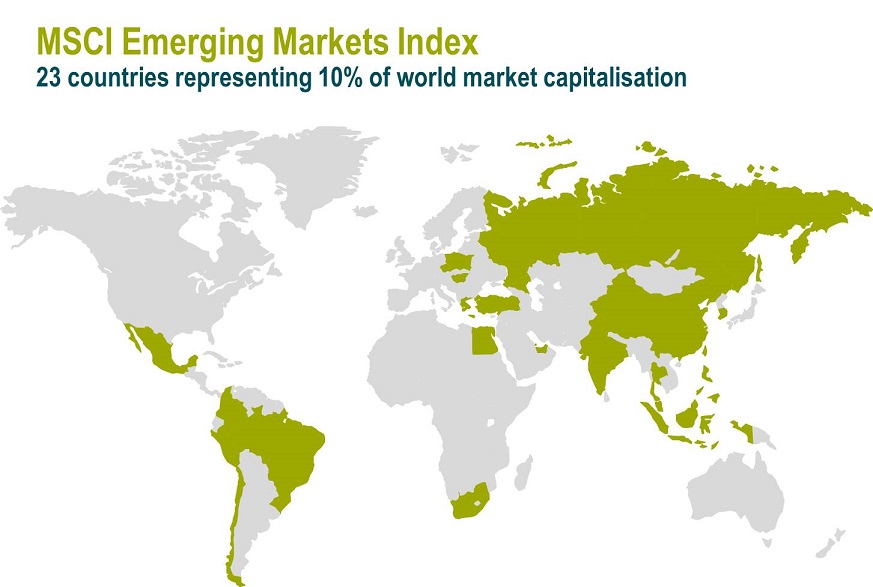

The MSCI Emerging Markets Index is comprised of equities from 23 emerging markets representing 10% of the world market capitalization.

Click to enlarge

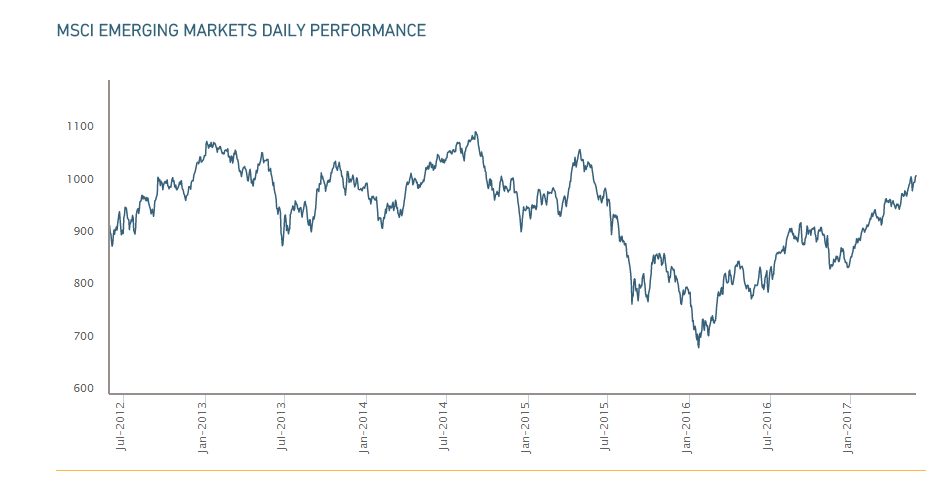

The long-term daily return of the MSCI Emerging Markets Index since 2012 is shown below:

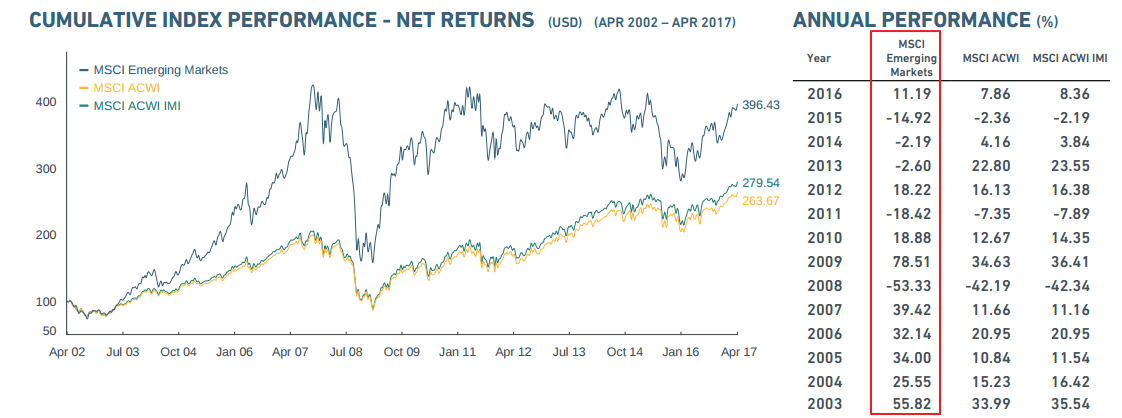

The long-term return of MSCI Emerging Markets Index vs. MSCI World Index is shown below. The MSCI World Index represents the developed world markets:

The table below shows the annual return of the MSCI Emerging Markets Index vs. MSCI World Index:

Download: The MSCI Emerging Markets Index Factsheet (in pdf)

Sources:

- MSCI

- Six myths about emerging markets, M&G Investments, UK

Earlier:

Related ETFs:

- iShares MSCI Emerging Markets ETF (EEM)

The iShares ETF has an asset base of over $31 billion. The Vanguard MSCI Emerging Markets ETF (VWO) is benchmarked to the FTSE Emerging Markets Index and not the MSCI Index. A few years ago Vanguard switched their benchmark to the other index provider FTSE. The fund has over $72 billion in assets.

Disclosure: No Positions