Politics generally does not have a strong impact on the stock market especially in the long-run. Major political events such as the unexpected outcome on election may have a short-term impact but over the years politics does not determine the performance of stocks.

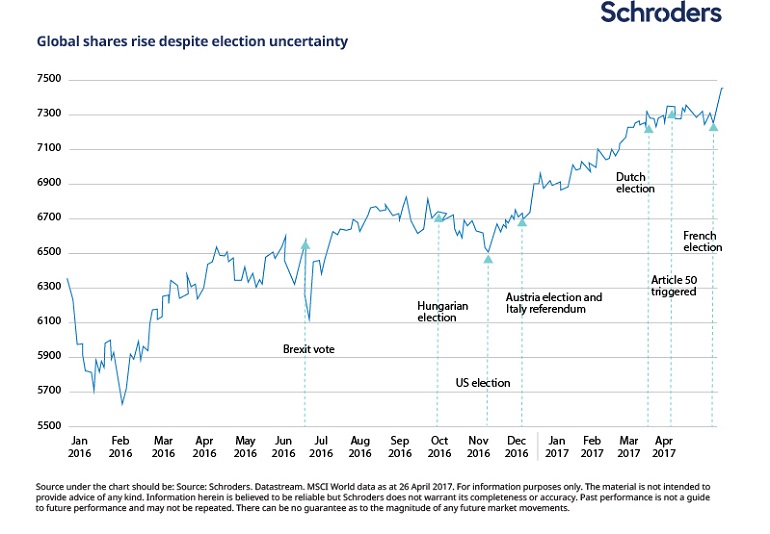

Since 2016 major political events have had negligible impact on stocks. The MSCI World Index has continued to move higher despite negative events such as the Brexit as shown in the chart below:

Click to enlarge

Source: A political checklist for stockmarket investors, Schroders

From the above article:

Since a post-Brexit low of 6,105.5 on 27 June, the MSCI World index – a broad measure of global stockmarkets – has risen by nearly 20%.

$1,000 invested in global shares on a total return basis, if we include dividends, on 27 June 2016 would now be worth $1,200. This is with inflation taken into account.

The key takeaway for investors from the above chart is that politics does not drive the performance of stocks. When political shocks such as the Brexit or the outcome of the recent US elections do occur, investors should not get carried away. Instead they should focus on their long-term goals and try to take advantage of any short-term dislocation in equity prices.

Related ETFs:

- iShares MSCI Emerging Markets ETF (EEM)

- Vanguard MSCI Emerging Markets ETF (VWO)

- SPDR S&P 500 ETF (SPY)

- Vanguard Dividend Appreciation ETF (VIG)

- SPDR S&P Dividend ETF (SDY)

- iShares Dow Jones U.S. Select Dividend ETF (DVY)

Disclosure: No Positions