“Prediction is very difficult, especially about the future.” – Niels Bohr

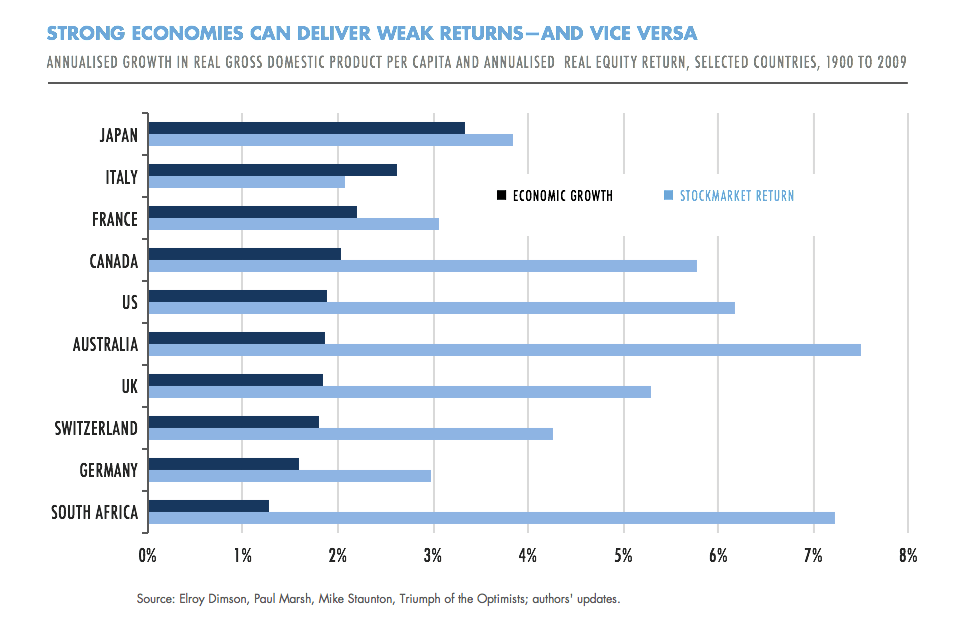

Forecasting economic trends is difficult especially trying to predict the performance of equity markets relative to the economic trend. For example, the relationship between equity returns and economic growth for a given country is tenuous at best. To put it another way, just because a country’s economy is growing strong does not mean it will lead to higher equity returns and vice versa. It is perfectly possible for a stagnant or low growing country to produce excellent equity returns.

The following chart shows the negative correlation between GDP per capita growth and real equity returns:

Click to enlarge

Source: Beware the siren song of growth, Dan Brocklebank, Allan Gray

Analysis of data over a century and across 19 countries proved the above theory according to the author Dan.

Similarly predicting industry trends is also a fool’s game. Simply going with what is hot does necessarily produce the best returns. Dan uses the example of equity investments in IBM (IBM) and Altria(MO) back in the 70s to prove this point. From the article:

Imagine if you could go back in time to the early 1970s. Armed with perfect foresight, you would know that computers, smartphones and all sorts of technology would become ubiquitous. You would also know that smoking would eventually be banned in many public places and the tobacco industry would be subject to costly lawsuits and onerous regulation. With that in mind, would you have invested in technology or tobacco stocks?

Intuitively, it would seem to be an easy decision. But you may be surprised to learn that the largest tobacco stock at the time would have been a massively better investment than that era’s largest technology company. A US$1,000 investment in IBM on 1 January 1975 would have grown to US$48,000 at the end of 2016—not a bad result. But a similar investment in tobacco company Philip Morris—now known as Altria—would now be worth about US$1.2 million!

The main reason why foresight has proved so poor in this regard is that growing industries tend to be glamorous and attract both talent and plenty of new competition. In contrast, the low-tech and litigation-prone tobacco industry experienced a considerable decline in competition, leaving the incumbents to make substantial profits as existing competitors left the business. When did you last meet an MBA graduate who said his ambition in life was to start a new tobacco company?

The two takeaways from this post are: investors should not assume fast-growing economies will produce great equity returns and today’s hot technology or industry trend may may not be the best place to park your money for long-term superior returns.

Disclosure: No Positions