Global small cap stocks are attractive now compared to large caps based on valuation, according to an article by David Brett at Schroders.

Small caps as measured by the MSCI Small Cap Index has returned three times as much as large caps since March 2001. Small caps returned 317% including dividends compared with 107% for the MSCI Global Large Cap Index.

From the article:

Do small caps remain good value?

On average small-cap valuations have so far remained relatively attractive, despite their rapid rise.

One way to value individual shares or the stockmarket as a whole is to compare share prices and earnings in a price-to-earnings ratio (P/E). A lower P/E ratio suggests better value.

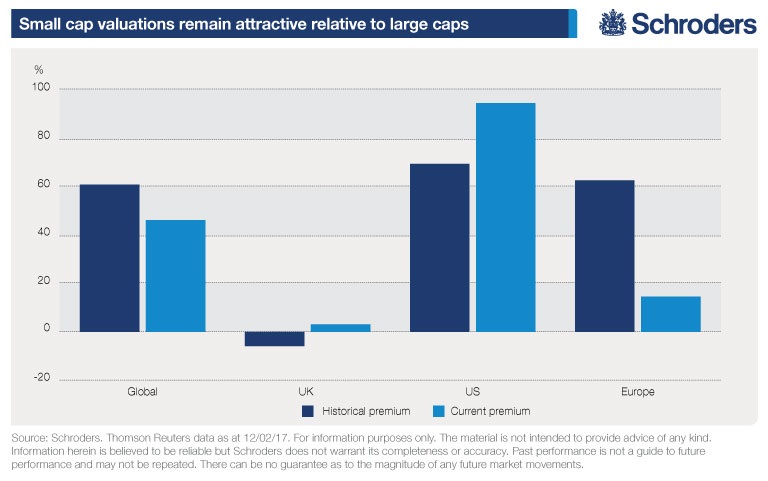

Global small caps’ 10-year median P/E is 25.8, compared with large caps’ P/E of 16. So on average global small caps have traded on a 61% premium to large caps since 2007.

The premium is currently 46%. Small cap P/Es have risen to 30.8 from 27.5 in 2007, while large cap P/Es have climbed to 21 from 16.3.

Regional bias

Global and European small caps trade below their historical (10 years from Q4 2006 to Q4 2016) median premiums, compared with large caps, according to MSCI data. The US and the UK appear more expensive.

Source: Small cap vs large cap: how valuations compare, Schroders

Generally investing in small companies involves more risk than larger companies.Since higher risk means the possibility of higher reward they tend to perform better than large caps. Though definitions of a small cap can vary, usually companies with market caps of less than $1.0 billion can be considered small companies. Researching and identifying individual small companies to invest in is more time-consuming than large ones since the universe of available firms is huge. So it may be easier for most retail investors to go with small cap ETFs.

Related ETFs:

- iShares MSCI EAFE Small-Cap ETF (SCZ)

- Vanguard FTSE All-World ex-US Small-Cap ETF (VSSS)

- SPDR S&P International SmallCap ETF (GWX)

Disclosure: No Positions