Bank stocks have soared since the election of President Trump. Compared to the overall market banks are up by double digit percentages.For example, the Financial Select Sector SPDR® Fund ETF (XLF) is up by over 46% at the end of February with most of that return accumulated since the election. Compared to the S&P 500’s 5.63% year-to-date (YTD) return the fund is up 5.55% YTD. The reasons for the explosion of this sector are many including looser regulations, higher interest rates, etc.

So many investors may be wondering of financials have came off too far too fast and more importantly if they are cheap. According to two recent article they seem to be inexpensive now despite the tremendous run in the past few months.

From a Fidelity article:

How has the market reacted?

The market has realized that banks stand to benefit from many of the new administration’s prospective changes. But there’s still a lot of uncertainty. The real debate now is about how quickly and to what extent policy changes play out, and the extent to which policies other than those related to taxes and regulations, such as trade policy and foreign policy, affect the growth outlook and, in turn, the financials sector.

The stocks that have done best have been bank stocks, particularly those of U.S.-centric regional banks, highly regulated non-banks, and trading-oriented investment banks. This makes sense because return on equity—which is a key driver of valuation and stock performance—is poised to improve from depressed levels if these factors unfold favorably.

There are risks, of course. Foreign policy and global macroeconomic shocks associated with big policy changes may diminish investors’ appetite for risk, hurting stock prices. For example, if risk premiums rise because investors become anxious about changes in foreign policy, that could depress asset prices. Financial stocks would be very sensitive to these changes given the levered nature of their business models.

These stocks have also moved a lot, so there is a risk of buying when prices are high. It will depend on how much the expectations translate into improved earnings.

Source: What deregulation may mean for bank stocks, Fidelity

Here is another take on the sector from Russ Koesterich at Blackrock:

While some of the gains have come down to improvements in fundamentals, as with the broader market, much of the gains have been driven by more expensive valuations. The price-to-book ratio (P/B) on the sector is up over 40% from last summer’s lows. That said, valuations are still about 25% below the average since the early 1990s, although the P/B is now creeping back towards the post-crisis high.

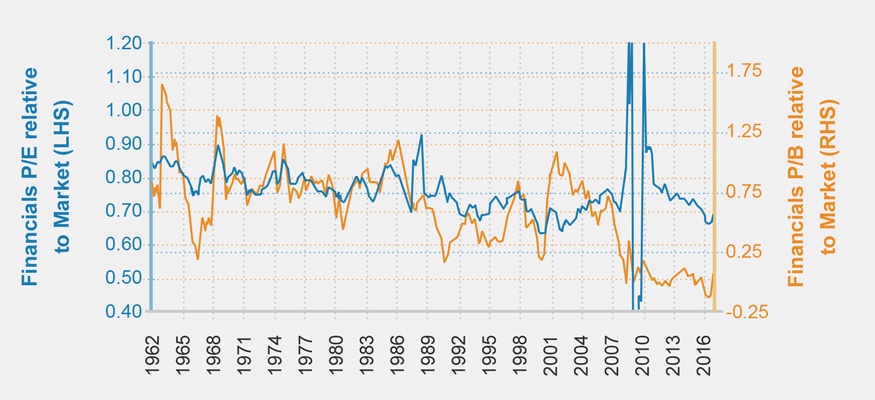

Valuations look less pricey relative to the broader market, which may say more about extended U.S. stocks than cheap banks. Large cap banks are trading at a 60% discount to the broader market. This looks very reasonable against a 25-year horizon, during which the average discount was only around 40% (see the accompanying chart). However, as with absolute valuations, relative value is less enticing when compared to the post-crisis norm. Relative valuation for large U.S. banks is now back to the highest level since early 2014.

He also notes that while bank stocks look cheap, from a Return on Assets (ROA) perspective they are still lower than before the financial crisis of 2008-09. The ROA was for large banks was 1.20% in 2006. Since 2011 it was at around 0.95% and has been even lower recently. So the ROA has not improved and returned to pre-crisis levels and the jump in bank stocks is mainly due to expectations for better times ahead.

Source: Are U.S. banks still cheap?, Blackrock Blog

Related:

- SPDR Financial Select Sector ETF (XLF)

Disclosure: No Positions