One of the topics that I have written many times on this blog is the concept of Market Timing. This strategy involves selling at market peaks and buying at market lows. While this sounds pretty simple, obviously it is impossible to execute for any investor. If it was so easy to do, then everyone will be making money in the equity market. Even professional money managers playing with other people’s money fail in timing the market. Since it is very important for retail investors to avoid trying to identify the market tops and bottoms and execute trades accordingly let me discuss why market timing never works in this post using the example of the British equity market.

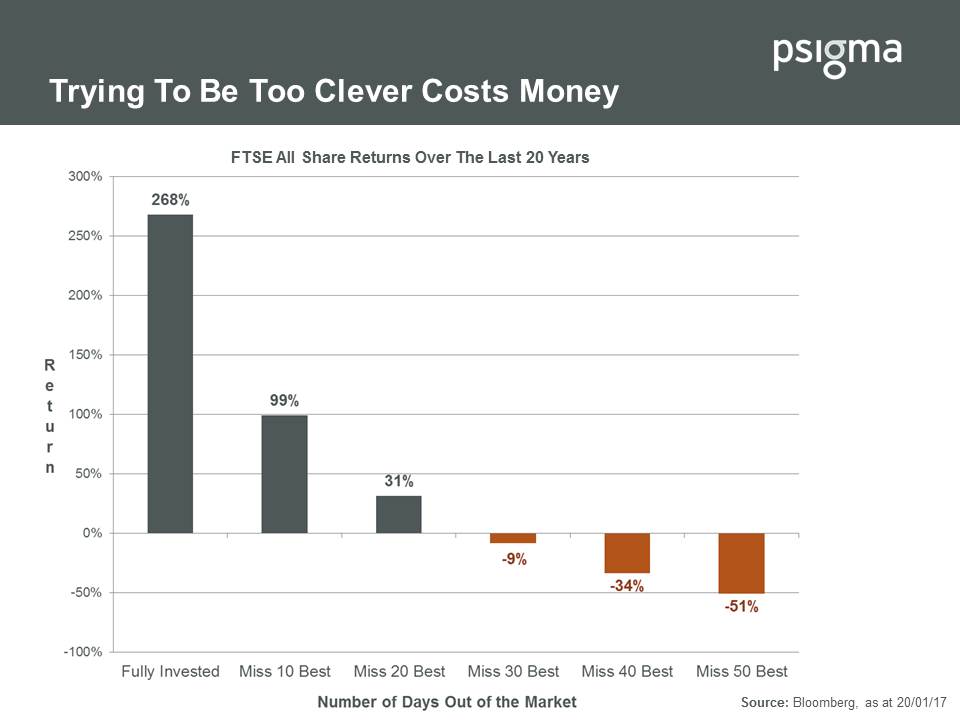

The following chart from an article by Rory McPherson at pSigma, UK shows the adverse impacts of market timing in the British market:

Click to enlarge

Source: Asset Allocation – “Keep Calm and Stick to the Plan…”, pSigma Hat-tip: Money Observer

Mr.Rory noted the astonishing fact:

As the chart above shows, missing the best ten days of performance in the last twenty years of UK stock market returns would have cost you 170%! In fact, if you’d missed the best thirty days returns then you’d have lost money over that twenty-year period instead of almost tripling your wealth. (emphasis mine)

The more best days of the market an investor misses, the worst their returns are.

Note the returns shown above are for the FTSE All Share Index and not the popular FTSE 100.

So in a nutshell, retail investors should not try to time the market.Instead investors are better of holding a diversified portfolio thru the market’s roller-coaster days.

Below are some of the recent geo-political events that shook investors’ confidence:

- Crude oil price collapse in the past few years. As prices continued to tumble analysts and pundits predicted it would reach $10 or a below for a barrel and a global recession. This prediction failed.

- UK’s vote for Brexit last June. Fears of total collapse of UK and possibly the EU proved wrong. Markets simply shrugged off this political drama.

- Election of Donald Trump as US President in November. Almost overnight markets’ mood changed abruptly with stocks soaring ever since. All the predictions of crash if he got elected turned out to be incorrect.

- Other significant events in the past that also did not crash the global equity markets are the Greek sovereign debt crisis, EU debt crisis, PIIGS crisis, commodity markets plunge, etc.

All thru these crises markets continued to move forward and today many global markets including the US are in record territory.

Below is an excerpt from an article at MarketWatch on market timing:

If you had a crystal ball and knew that a peaking stock market was about to drop 30%, what would you do?

About a week ago I found myself talking about retirement planning with a fellow saver who confidently offered: Stop contributing to your 401(k). They argued that it’s better to wait for the market to tumble then get back to contributing to a retirement savings plan because much of what you save now will be eroded by the market crash.

There are compelling reasons to conclude that the stock market is near its peak. The S&P 500 SPX, +0.50% which has been rising since early 2009, is up 26% over the past 12 months, trading at all-time highs. It is, by many measures, at very stretched valuations. The cyclically adjusted price-to-earnings ratio, or CAPE, at 29 is at extreme levels, seen only twice over the past century, in 2000 and 1929.

Source: Here’s why market timing is bad for your retirement goals, MarketWatch