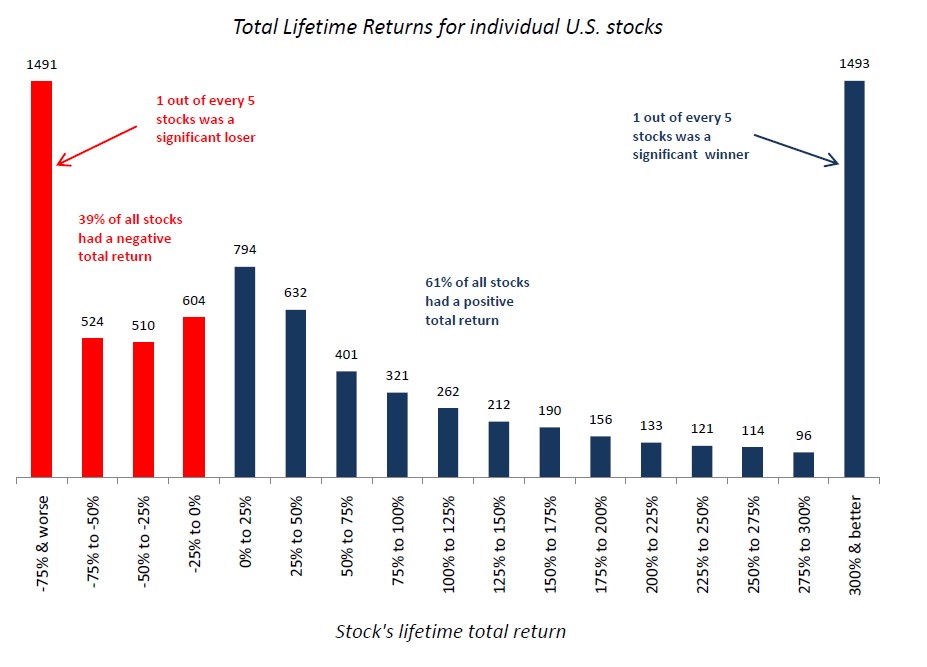

Investing in equities is a great way to build wealth over the long-term. Equity markets have created many millionaires and billionaires. However it is important to note that not all stocks are wealth creators in the long-term. According to a study by ValueWalk in 2015, 39% of U.S. stocks were money losers over their lifetime. Or to put it another way they yielded negative lifetime total returns.

They study involved 8,054 US exchange-traded stocks from 1983 to 2015. 2 out of every 5 stocks were money losers. A small portion (25%) of equities accounted for most of the gains during the period.

Click to enlarge

Source: 39% Of Stocks Have A Negative Lifetime Total Return, ValueWalk

The key takeaway is diversification is very important for success with investing in stocks. Otherwise there is a high risk that one’s investments may not produce the required returns over man years, In fact, it is easily possible to lose money if an investor makes a concentrated bet on a few stocks and they end up as losers.