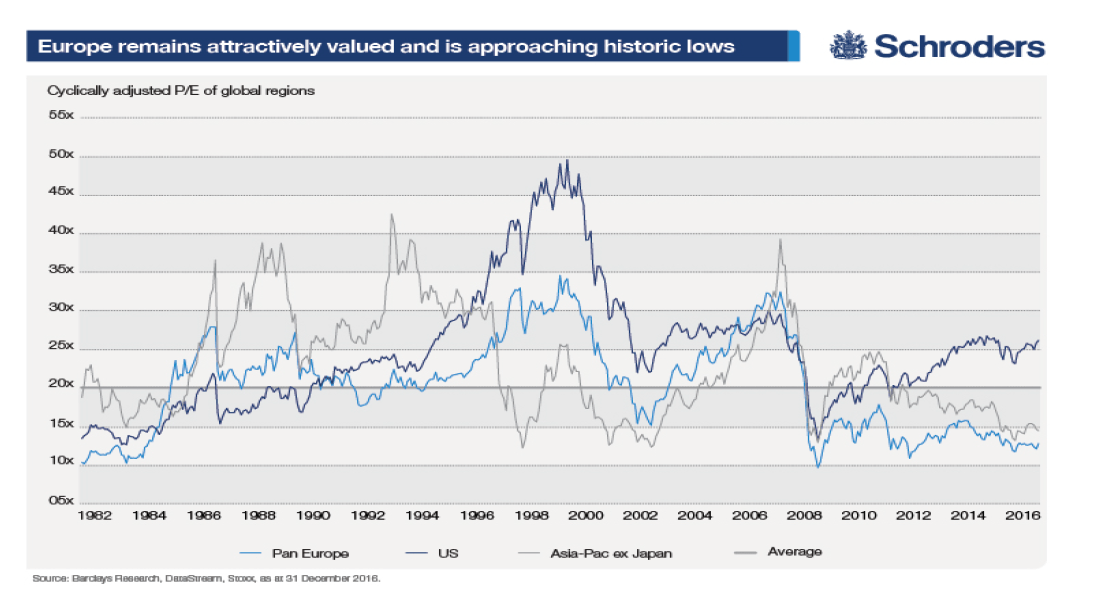

European equities are attractive now relative to Asia-Pacific excluding Japan and US equities based on cyclically-adjusted P/E ratio. As the chart below shows the ratio is at 2009 levels for European stocks.

Click to enlarge

Source: EuroView: Rotation, earnings recovery and a view from the US, Schroder’s

According to the above report by Schroder’s, in the past stocks from Europe disappointed investors even though they were attractive. However this time it could be different since many sectors are recovering from troughs. As earnings estimates improve and firms generate higher profits, re-rating of stocks could propel them to higher levels. So as markets are forward-looking and P/E ratios will expand should earnings recover, higher multiples will lead to higher stock prices.

Some of the stocks that could be re-rated and offer potential growth opportunities are: ING Groep NV (ING), Banco Santander SA (SAN), Total SA (TOT), Nestle SA (NSRGY), Henkel AG & Co KGaA (HENKY),Siemens AG (SIEGY), Unilever NV (UN). etc.

Disclosure: Long ING and SAN