In the world of stock market investing, cutting losses is more important than holding on to gains. The courage to cut and protect remaining capital is especially critical when a stock plunges heavily leading to sever losses in portfolio. It is much easier for anybody to hold on to stocks that continue to go higher. Even one has to sell a gainer one can easily feel satisfied making a decent profit of say 25% or 505 or even 200%. However when a stock falls from say $10 to $5 or even $2 it is extremely difficult for anyone to sell out and move on. This is because we tend to hang on to hope even if that is misplaced that the stock would somehow recover. In other times, we are unwilling to accept the fact that we made a big mistake on that failed investment.

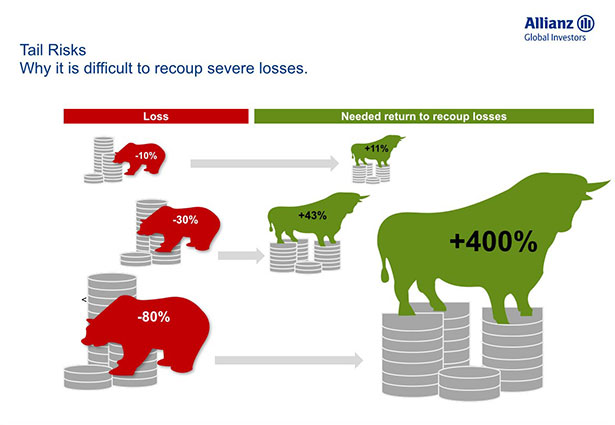

The following diagram shows why it is difficult to recoup sever losses:

Click to enlarge

Source: Allianz

A 10% loss requires a gain of 11% to break even. Similarly an 80% loss requires a gain of 400% to recoup original investment. For example, if a $10 stock declines to $2 for a loss of 80%, then it has to soar by 400% to get back to $10 – that is has to increase by 4 times. Simply increasing by 100% or doubling from $2 would only take it to just $4.

From an article by Jason Zweig at WSJ in 2011:

Research published in 1998 by behavioral-finance professor Terrance Odean of the University of California, Berkeley, showed that individual investors are 50% more likely to sell a winning stock than a loser—even though, on average, the stocks these investors sell go on to outperform while those they hold onto underperform.

Individual investors aren’t the only ones who can’t make peace with their losses, according to numerous academic studies. Mutual-fund managers who cling to losing stocks underperform, by roughly four percentage points annually, the managers who cut their losses.

On average, professional futures traders and stock traders hurt their returns by clinging to their losers. Real-estate investment trusts hang onto properties that are losing money longer than they keep those that are in the black.

Unpublished research presented at the annual meeting of the Society for Neuroeconomics earlier this month sheds new light on this old problem. Neuroeconomics is an emerging field that combines the techniques of neuroscience with theories from psychology and economics to study financial behavior.

In one study, led by Gregory Berns of Emory University, people lay inside a brain scanner while deciding to hold or sell an investment; the price of the asset changed randomly up or down. The researchers focused on the ventral striatum, a region of the brain that has been shown to respond to rewards, particularly when they are unexpected.

Source: Why We Can’t Let Go of Our Losers, Jason Zweig, WSJ, October 15, 2011

So the key takeaway here is that when there is a severe loss on a stock, it is important to analyze why the loss occurred and if it makes sense to hold on or simply cut the losses and move on to something else. Though it is emotionally draining to lose money, in the end it is only necessary to earn overall higher positive returns from a equity portfolio.

In a real life example, last year I sold out French bank Societe Generale SA (SCGLY) in an account with a huge loss. Luckily I was able to reinvest the remaining capital into Bancolombia SA (CIB), a Colombian bank in the low $20s and was able to recoup a substantial portion of the loss. Of course this is only an example where it worked out. In some instances, it may take years to recoup thousands of losses. The key factor in the SocGen saga was the willingness to cut losses and move on.While selling out a stock with a huge loss was painful, recovering the loss with a replacement stock is much more satisfying.

Disclosure: Long SCGLY, CIB