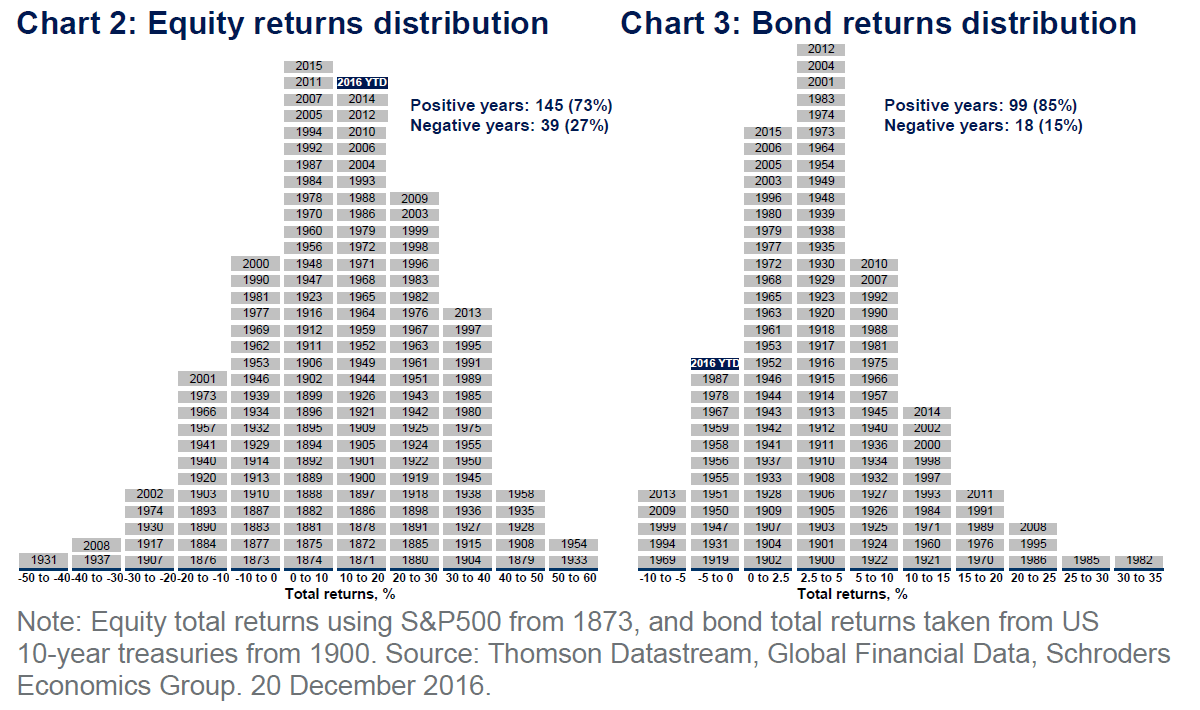

The S&P 500 Total Returns since 1873 and US Treasury Total Returns from 1900 are shown in the chart below:

Click to enlarge

Source: Schroders Economic and Strategy Viewpoint, Jan 2017, Schroders

In 2016, US stocks earned an above-average return when compared to their historical returns. U.S. treasuries on the other hand had their 17th worst year since 1900.

The above chart also shows over the long-term, equities as measured by the S&P 500 earned a positive return in more years than negative return. Or stocks earned a positive return in 73% of the years since 1873. So while most people will not own stocks for such a long period, it does however show that if stocks are held over many years one can earn a positive total return.

Update:

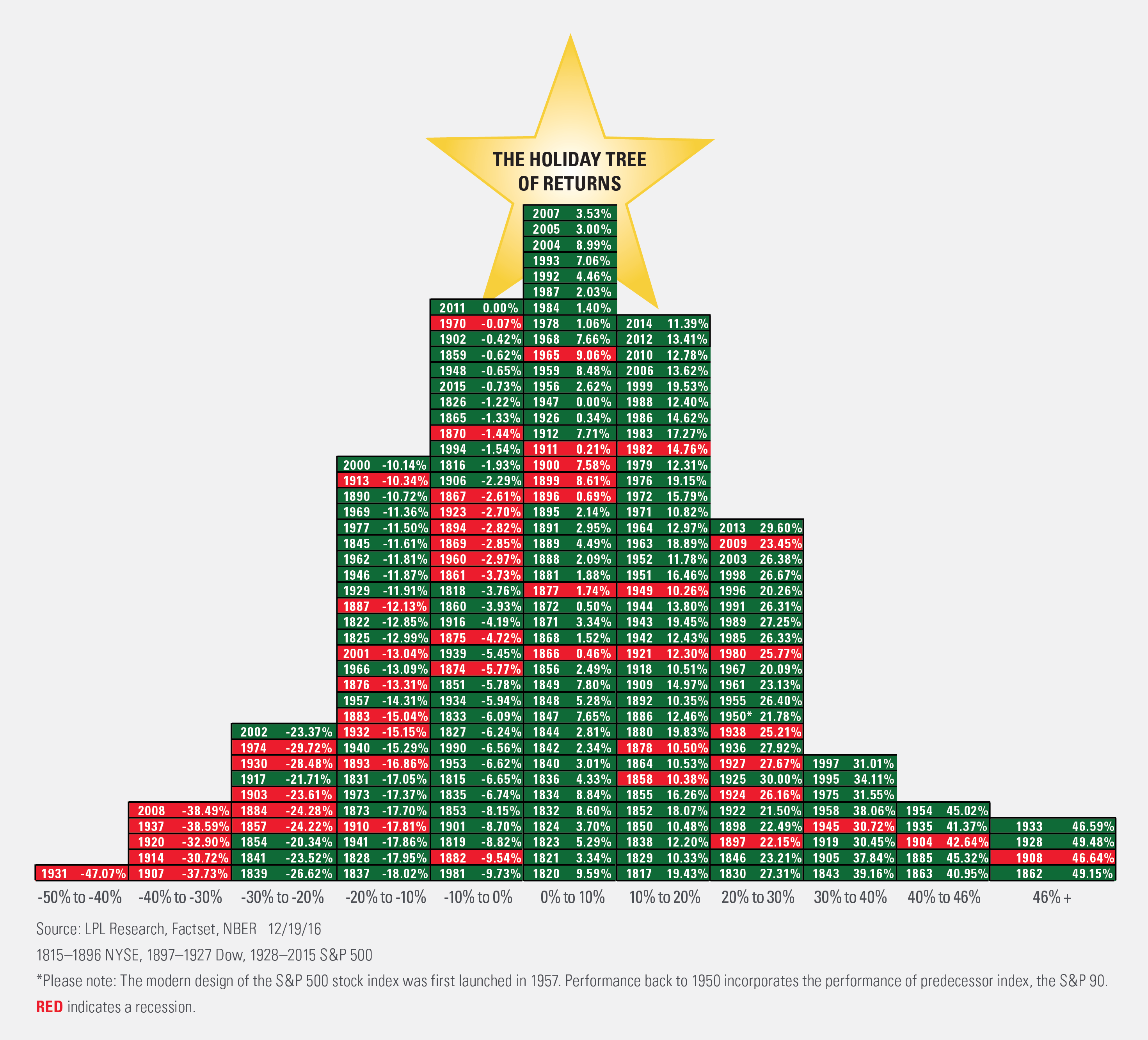

The Holiday Tree of Returns for the S&P 500

Click to enlarge

Source: LPL Financial

Hat Tip: The Big Picture

Related ETFs:

Disclosure: No Positions