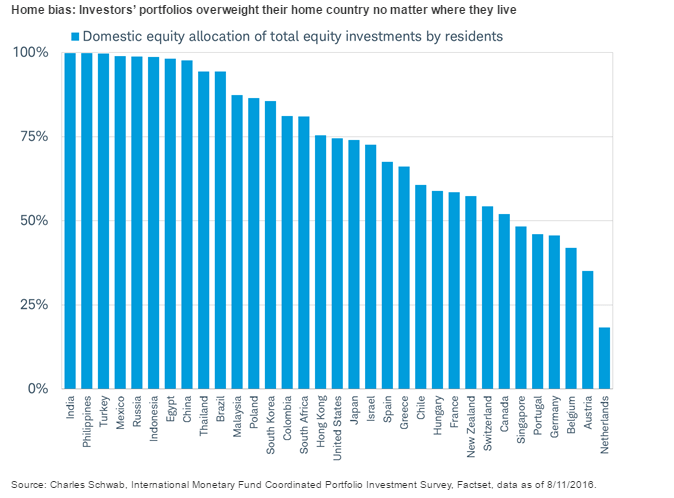

Investors across the world tend to biased towards their own country’s equity markets and accordingly overweight their portfolios with domestic stocks. However this home bias strategy can adversely affect an investor’s returns due to lack of diversification and depending too much on the domestic equities.

The chart below shows how the home bias issue varies among countries:

Click to enlarge

Source: Your portfolio may be less diversified than you think, By Jeffrey Kleintop, Charles Schwab, Aug 22, 2016

Jeff discusses the case of the equity markets of Canada, USA and Japan in terms of how they are heavily dependent on and follow the performance of specific sectors. Canadian stocks for example tend to follow the performance of the energy sector since Canada is a commodity-based economy and energy is the major driver of the economy.Similarly the US market performance mirrors the performance of the technology sector.

For optimal returns and reducing risks, investors should reduce their home bias and diversify their portfolios across sectors, countries and regions. Putting too many eggs in one basket is never a wise idea. Though it may seem unnecessary to venture abroad, investors need to at least allocate a small portion of their assets to overseas equities. This is especially important for investors in countries where the domestic market is highly reliant one sector.