European financials are under-performing so far this year. Banking stocks in particular have declined heavily due to a multitude of factors including fears of UK exiting from the EU.

Unlike the swift recovery of US banks, European banks never full regained their glory since the peak of the global financial crisis. Years of poor returns due to one crisis after another has left a poor taste for European banks among global investors. In short, European financials are rightfully being treated as rotten fish by investors.

Despite the negative sentiment, however, light may be at the end of the tunnel. According to a report by Franklin Templeton Investments, European financials are selling at a deep discount and offer attractive opportunities now.

From the report:

Investors appear to have completely lost confidence in European banks, and they have shown their disdain so far this year in the same way they have since the 2008-2009 financial crisis: When they hear a shred of negative economic news, they sell off the banking sector. Bank stocks have dropped 20% year-to-date,1 compared with European equities overall, which have slid a comparatively modest 4% during the same time frame.2

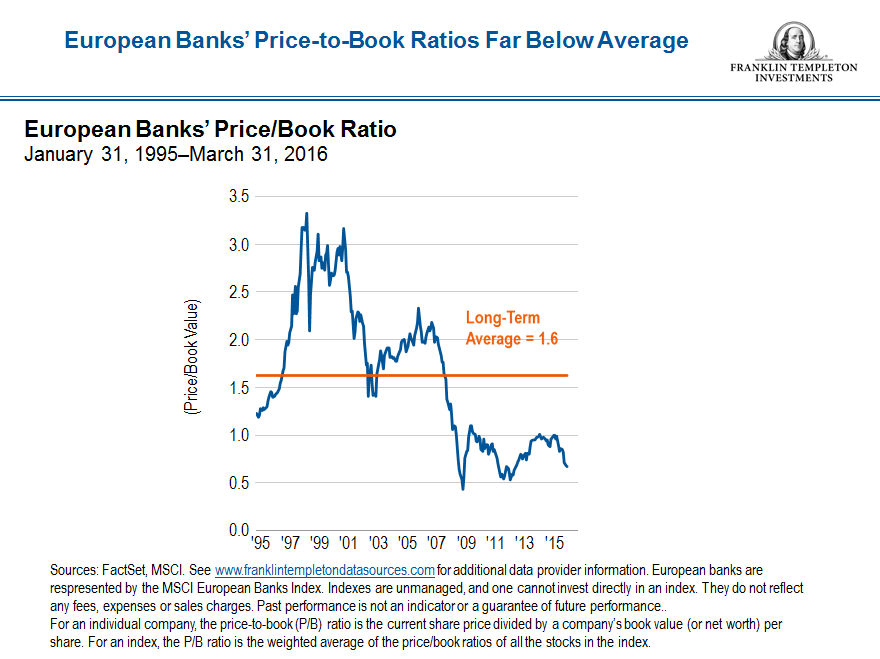

The malaise has dragged down the banking sector’s price-to-book (p/b) ratio3 toward lows it reached during the financial and European sovereign crises. And at 0.7, the sector’s p/b ratio is less than half its long-term average of 1.6.4 In our view, the banking sector is trading at extremely attractive levels, and we believe select banking and financial franchises have become excessively discounted, particularly taking into account what we consider bright spots on the horizon, which include a pickup in loan activity and increased dividend payouts.

What has stoked investor worries so far this year? The list features what we call the “triple whammy”: energy-company weakness, regulatory concerns and, perhaps most worrisome, negative interest rates.

Notes:

1. Source: STOXX Ltd., as of May 16, 2016. European banking stocks are represented by the STOXX Europe 600 Banks Index. Indexes are unmanaged, and one cannot invest directly in an index. They do not reflect any fees, expenses or sales charges. Past performance is not an indicator or a guarantee of future performance.

2. Source: STOXX Ltd., as of May 16, 2016. The overall European equity market is represented by the STOXX Europe 600 Index. Indexes are unmanaged, and one cannot invest directly in an index. They do not reflect any fees, expenses or sales charges. Past performance is not an indicator or a guarantee of future performance.

3. The price-to-book (P/B) ratio is calculated by dividing the current closing price of a stock by its book value for the most recent quarter-end. For an individual company, the price-to-book (P/B) ratio is the current share price divided by a company’s book value (or net worth) per share. For an index, the P/B ratio is the weighted average of the price/book ratios of all the stocks in the index.

4. Sources: FactSet, MSCI, as of March 31, 2016. European banking stocks are represented by the MSCI European Banks Index. For additional data provider information, see www.franklintempletondatasources.com.

Source: Can European Banks Rebound from the “Triple Whammy”? by Cindy Sweeting and Peter Wilmshurst, Franklin Templeton, May 31, 2016

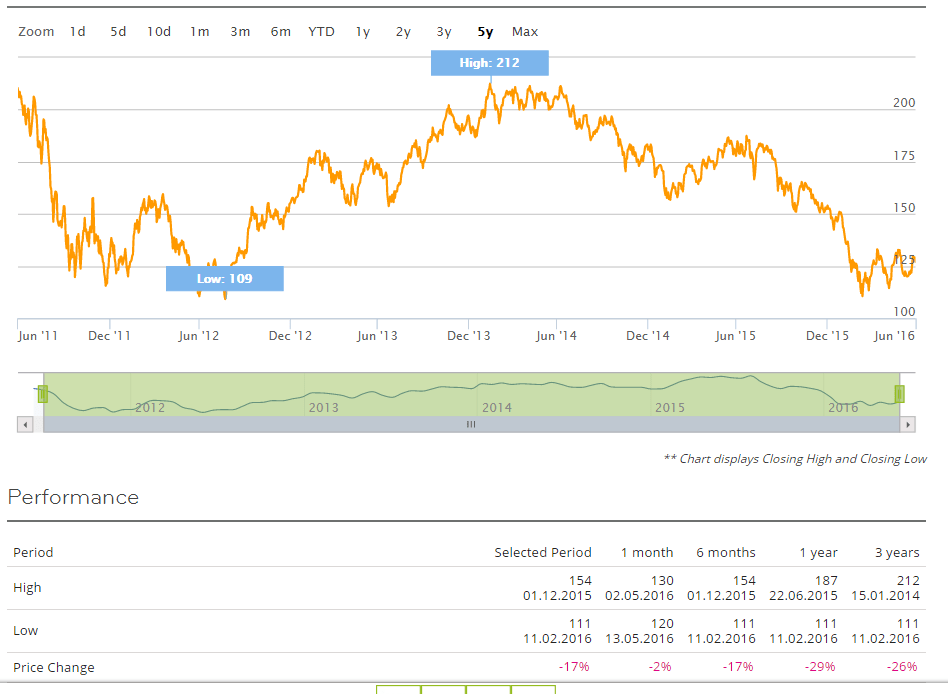

The STOXX® Europe 600 Banks Index which is the proxy for banks in Europe is down by 17% in the past 5 years in US dollar terms.

Click to enlarge

Source: STOXX

Among the constituents of this index, investors can consider ING Groep NV (ING), UBS AG (UBS),Nordea Bank AB (NRBAY), BNP Paribas SA (BNPQY) and Swedbank AB (SWDBY)

From a related article by Jason Zweig at WSJ:

Europe and emerging markets joined the U.S. this past week in rallying 2% to 3% as oil prices stabilized and investors became more comfortable with a possible interest-rate increase by the Federal Reserve next month. But stocks remain much cheaper overseas than in the U.S.

Consider price to book value, a measure of corporate net worth. Since 1970, according to data from MSCI, the average price to book value of European stocks has been about 25% below that of U.S. stocks. As of April 30, it is 40% lower. The dividend yield on European stocks, historically about one-third higher than in the U.S., is 69% higher.

Source: Hold Your Nose and Buy Europe, Jason Zweig

Disclosure: ING and SWDBY