German stocks have performed worse so far this year relative to other developed markets. For instance, the FTSE 100 is down just 1.38% compared to the DAX’s decline of 7.70%. The actual loss is even more since the DAX returns includes dividends when other indices do not.

From a May 20th article in the WSJ on this topic:

Despite the German economy gathering pace, its stock market has had a dismal year.

The headline DAX index has fallen fast this year, and stripping out dividends the performance looks even worse.

Unlike other indexes, from Britain’s FTSE 100 to the French CAC 40, the DAX measures gains on a “total return” basis. So instead of just taking into account changes in the prices of its stocks, this index includes dividends paid out by its component companies and assumes they are reinvested in the same stock. Another index that works like this is the American S&P 500.

This means the DAX tends to look better when compared with its neighbors.

Not this year. Even with dividends, the DAX is still down 8.8% year-to-date.

Other eurozone indexes haven’t fared well either. The CAC 40 has dropped 6.7% this year, the Spanish IBEX 35 is down 8.3% and the Italian FTSE MIB is down roughly 17.2%.

Strip out dividends and the DAX looks even worse, having lost 11.2% of its value.

Source: The German DAX’s Bad Year Is Even Worse Than It Looks, WSJ, May 20, 2016

Though the DAX has performed poorly this year, investors may still want to consider adding German equities in a phased manner at current levels. Listed below are three reasons on why investors should buy German equities:

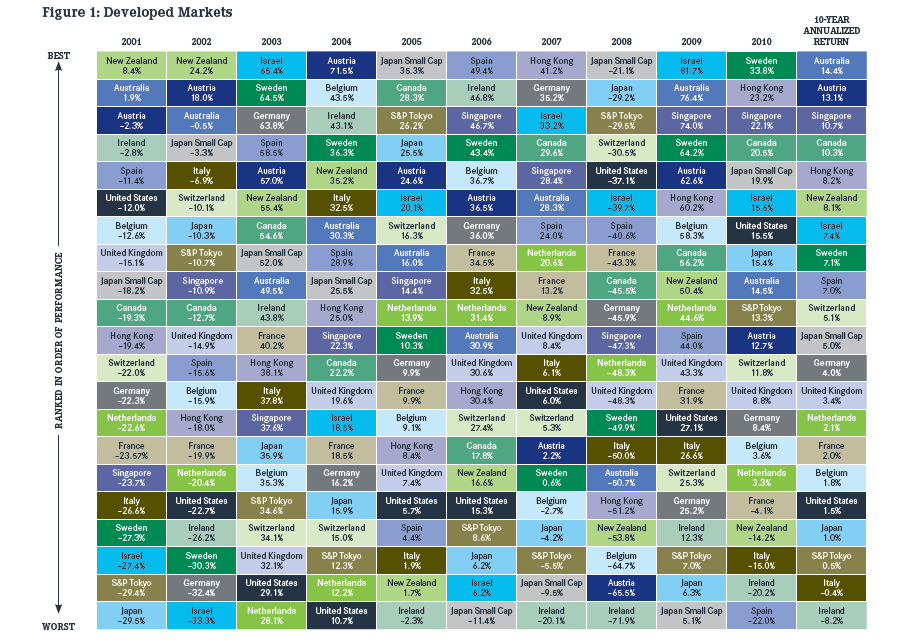

1.No country consistently ranks as the top performer year after after as shown in the chart below:

Click to enlarge

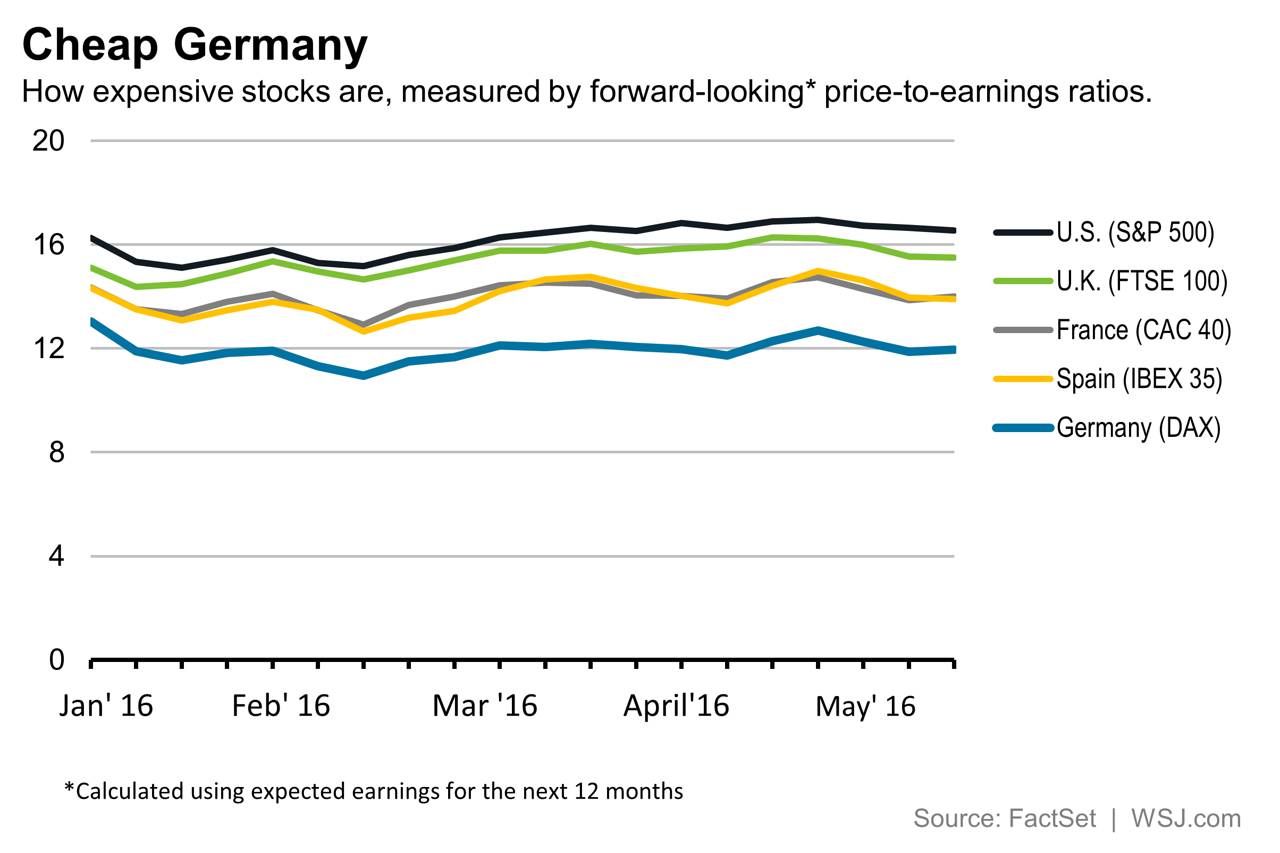

2.German stocks are cheap based on forward P/E ratio:

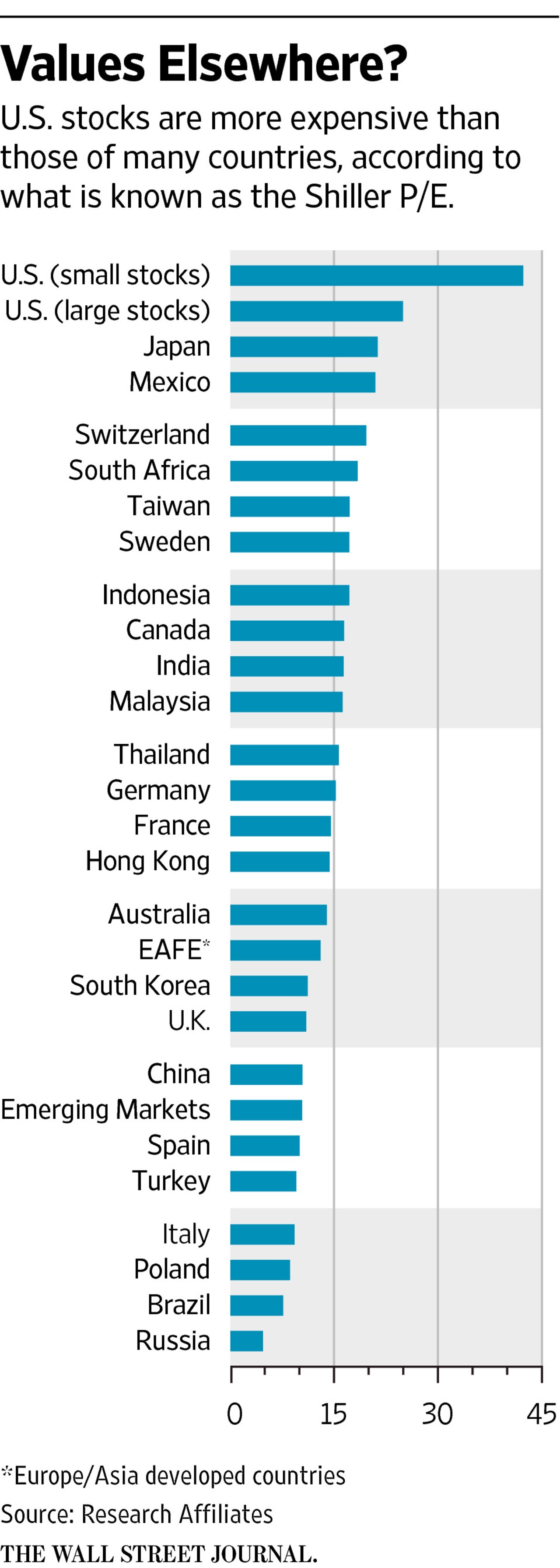

3.US stocks are expensive based on Shiller P/E ratio while German stocks are cheaper:

Shiller P/E (also known as cyclically adjusted P/E” or CAPE,) is a more accurate measure of predicting long-term returns.

Note: The above chart shows data as of May 7, 2016

Source: The Case for More Overseas Stock Exposure—and Where, WSJ, May 8, 2016

The easiest way to gain exposure to German stocks is via the iShares MSCI Germany ETF (EWG). It holds 55 large and mid-sized firms and currently has an asset base of over $4.2 billion.

Investors interested in individual stocks can consider the following for further research:

1.Company: BASF SE (BASFY)

Current Dividend Yield: 4.45%

Sector:Chemicals

2.Company: Henkel AG & Co (HENKY)

Current Dividend Yield: 1.61%

Sector: Household Products

3.Company: Siemens AG (SIEGY)

Current Dividend Yield:3.56%

Sector:Industrial Conglomerates

4.Company: adidas AG (ADDYY)

Current Dividend Yield: 1.44%

Sector:Textiles, Apparel & Luxury Goods

5.Company: Fresenius Medical Care AG & Co (FMS)

Current Dividend Yield: 1.08%

Sector: Health Care Providers & Services

Note: Dividend yields noted above are as of May 20, 2016. Data is known to be accurate from sources used.Please use your own due diligence before making any investment decisions.

Disclosure: No Positions