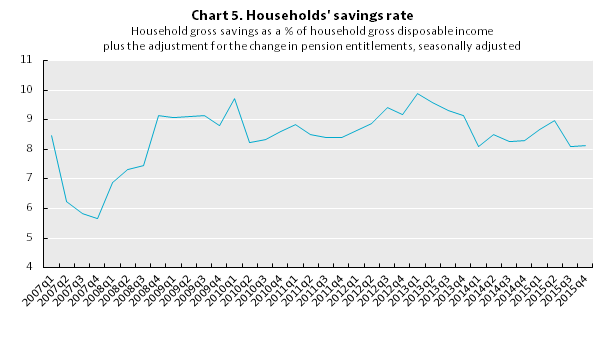

The Canadian Household Savings Ratio stood at 8.1% in Q4, 2015 according to a new report by the OECD. Currently the US personal savings rate stands at 5.4%. The savings rate in Canada tend to be traditionally higher than in the U.S.

Click to enlarge

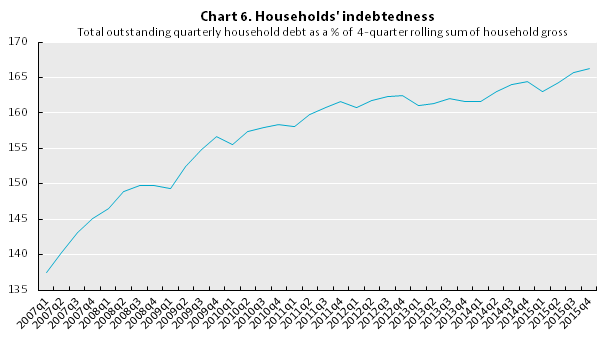

However Canadian household’s debt is also growing at an alarming rate. Much of the debt is due to taking on huge mortgages to buy houses. Since house prices are artificially inflated to bubble levels, it is not uncommon for people to pay a million C$ with a mortgage for a run-down shack-like houses in places like Vancouver.

An excerpt from the OECD report:

The households’ indebtedness ratio (i.e. the total outstanding debt of households as a percentage of their disposable income) is a measure of (changes in) financial vulnerabilities of the household sector and its evolution over time allows for an assessment of households’ debt sustainability. In Q4 2015, household indebtedness in Canada (Chart 6) increased to 166.2% of disposable income, its highest level since 1990. As mortgage debt makes up the largest component of household debt in Canada, Chart 6 shows that Canadian households have continued to increase their borrowings to finance house purchases, in the face of low interest rates and high house prices.

Click to enlarge

Source:A dash of data: Spotlight on Canadian Households, OECD Insights, May 10, 2016