One of the equity strategy topics that I discuss here often is the concept of ‘Market Timing’. This involves simply buying stocks when the market is down and then selling them when the market is at the top. Sounds simple. But if it were that easy then everyone would be a millionaire. In reality, timing the market does not work for almost all investors. Even professional fund managers who manage other people’s money for a living with teams of experts, sophisticated computer models and other better information fail miserably trying to time the market. So for retail investors it goes without saying that they should not time the market. In fact, the time in the market is more important than timing the market,

For example, investors who panicked and sold out at the trough of the global financial crisis of 2008-09 ended up with losses.On the other hand, those who stayed put and did not take a single portfolio action (i.e. either buying or selling) are now sitting on nice gains as the S&P 500 has more than doubled since then. Using the concept of market timing, early 2009 would have been an excellent time to buy stocks at dirt cheap prices. However majority of the investors including myself did not have the guts to invest any new money in the market. I remember reading about one French fund manager who was vacationing somewhere in Thailand in early 2009 and had watched the market crashing to new lows. He had the instinct to immediately plough millions of dollars of his firm’s assets into top-quality stocks at low prices. Many years later he recalled how his fund holdings had soared in value as markets recovered all those losses and then moved even higher. However managers such as this one are very very rare indeed.

Going to market timing, the easiest thing for most retail investors to build a diversified portfolio and hold it for the long-term. In fact, market panics like earlier this year’s collapse are a great time to pick up additional stocks if one has the funds to invest and has identified stocks to buy. Some of my earlier articles on market timing can be found here and here and here and here and here.

Timing the market does not work in any market. Emerging markets are no exception. In fact, emerging markets by definition are more volatile and it is foolish to time the markets in emerging equities. It is not uncommon for individual stocks in emerging countries to soar or decline by 10% or more in a single day. Similarly markets as a whole tend to fall fast and soar high almost overnight.

I came across an fascinating article that shows how market timing does not work in emerging markets also.

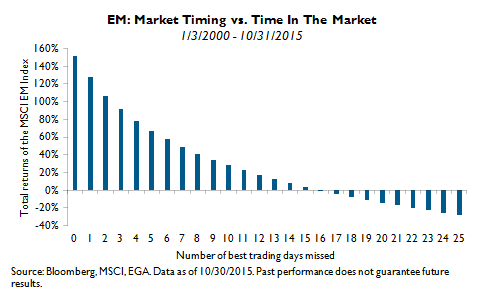

Click to enlarge

From the article:

‘Time In’ the markets. Missing just a few of the best performing trading days can be significantly detrimental to returns. Total returns for the MSCI EM Index since 1/3/2000 until 10/30/2015 has been 151%, but this number falls sharply if the best daily returns are excluded. As the chart shows, if the 16 best trading days out of 4,131 total days were missed, the total return of the MSCI EM Index drops to below zero. Missing the best 25 days brings investors significantly below zero. We believe that investors should consider that ‘timing’ the markets is not as important as ‘time in’ the markets.

Source: Market Timing vs. Time in the Market, Emerging Global Advisors, LLC

Related ETFs:

Disclosure: No Positions