Companies that grow dividends year-after-year tend to outperform based on total returns those that just pay dividends. One of the reason for this outperformance is due to the effect of compounding. When additional shares are purchased with dividends reinvested every year, over many years the returns are amplified.

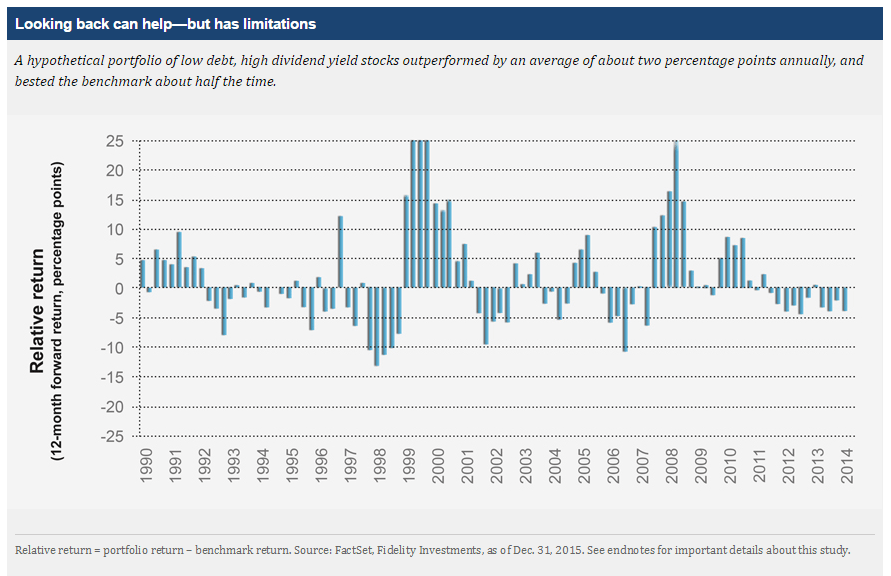

The following chart illustrates the above theory:

Click to enlarge

Source: How to pick dividend stocks, Fidelity Investments

So instead of focusing on stocks with high dividend yields, investors must pick dividend growers for a long-term portfolio.

The S&P 500 Dividend Aristocrats Index measures the performance of S&P 500 companies that have increased dividends every year for the past 25 consecutive years. The top constituents of this aristocrats index are listed below with their current yields:

1.Company: Grainger W.W. Inc (GWW)

Current Dividend Yield: 2.04%

Sector: Industrials

2.Company: Cincinnati Financial Corp (CINF)

Current Dividend Yield: 2.95%

Sector: Insurance

3.Company: Illinois Tool Works Inc (ITW)

Current Dividend Yield: 2.15%

Sector: Industrials

4.Company: McCormick & Co (MKC)

Current Dividend Yield: 1.79%

Sector: Consumer Staples

5.Company: Dover Corp (DOV)

Current Dividend Yield: 2.59%

Sector: Industrials

6.Company: Leggett & Platt (LEG)

Current Dividend Yield: 2.72%

Sector: Consumer Discretionary

7.Company: Emerson Electric Co (EMR)

Current Dividend Yield: 3.48%

Sector: Industrials

8.Company: Genuine Parts Co (GPC)

Current Dividend Yield: 2.69%

Sector: Consumer Discretionary

9.Company: Target Corp (TGT)

Current Dividend Yield: 2.75%

Sector: Retail

10.Company: 3M Co (MMM)

Current Dividend Yield: 2.70%

Sector: Industrials

Note: Dividend yields noted above are as of Mar 24, 2016. Data is known to be accurate from sources used.Please use your own due diligence before making any investment decisions.

Disclosure; No Positions

but what about non-US dividend growers ?

mati

Yes. Thats a good point. I haven’t found any research data on that. I will use this idea for a future post. Thanks.