Mobius and his team think that Mexico is a standout in Latin America. Some of the reasons for this uniqueness include the country’s closeness to the U.S. and dependence on the US economy, less reliance on oil revenues, etc.

From a recent blog post by Rodolfo Ramos Cevallos, Templeton Emerging Markets Group:

Over the last two decades, Mexico has taken decisive steps to integrate with the global economy through trade agreements, so it can be affected by external factors such as slowing global growth. While 2015 was a challenging environment for investors—including those in Mexico—we think Mexico stands out from many other countries in Latin America, and as well as other emerging markets, for a number of reasons. Mexico has developed into a high-value-added exporting powerhouse to the United States. It has passed structural reforms geared to encourage competition and attract investments at a time when most countries are shying away from private investment and liberalization, and it has stable fiscal and macroeconomic management. Because of this differentiation, Mexico’s equity market has been able to outperform broader Latin America as well as emerging markets overall (as measured by MSCI indexes) in the last one-, three- and five-year periods.1

Currently, we are seeing opportunities in the export sector, which has benefited from a weakening in the Mexican peso versus the US dollar over the past couple of years. The automotive industry is a good example; Mexico is the seventh-largest automobile manufacturer in the world and largest supplier of automobile parts to the United States.2 Production of light vehicles has been on the rise, expected to grow from 3.2 million units annually in 2014 to more than 5 million units by 2020.3 We are also seeing bargains in the mining sector. While the mining sector has been out of favor in recent years, we have been able to find cost-competitive companies in Mexico with solid balance sheets that appear well-positioned to potentially benefit when the cycle turns.

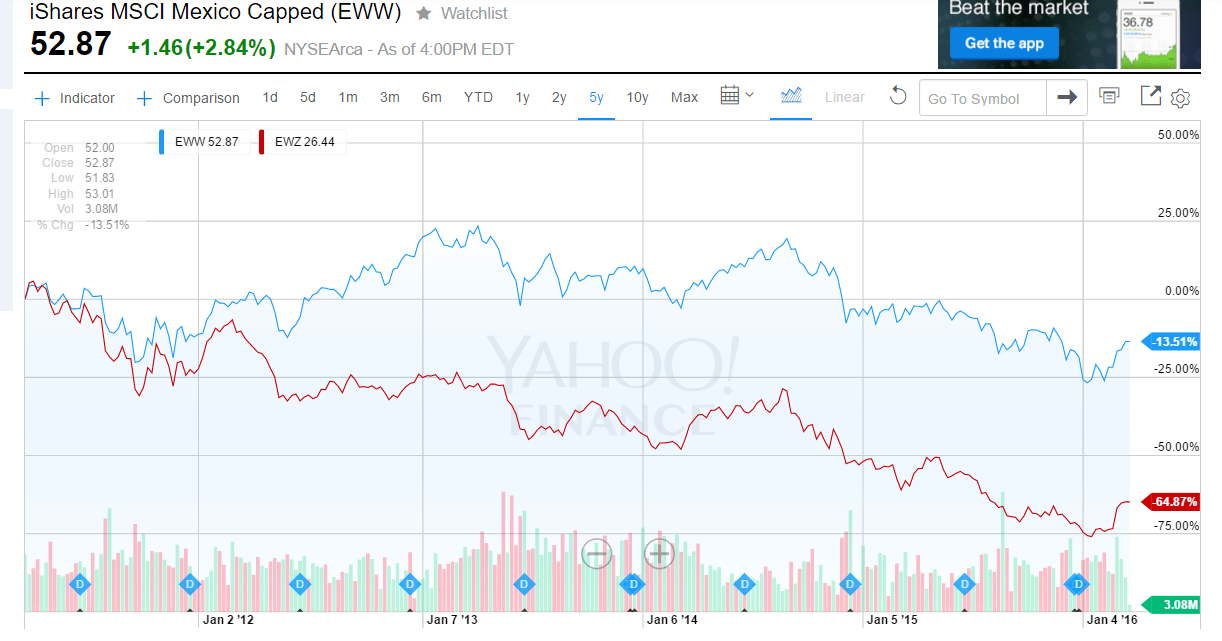

In recent years, Mexico has performed well when compared with the former emerging markets favorite Brazil. The chart below shows the 5-year wide gap in returns of the country ETFs for these two markets:

Click to enlarge

Source: Yahoo Finance

On the impact of oil on the Mexican economy he wrote:

While oil is meaningful to the Mexican government in terms of revenues, Mexico’s reliance on oil is considerably less than is commonly believed, as oil represents only about 10% of its exports.5 With the decline in oil prices and an increase in economic activity, oil’s importance in Mexico has been significantly reduced in the last couple of years, with income tax and value-added tax (VAT) picking up the slack. Oil’s contribution to the federal budget has dropped by half in the last couple of years from about 40% in 2008 to about 20% in 2015.6Unfortunately, consumers have generally not seen lower prices at the pump yet, but with the liberalization of the oil sector that could change in the coming years.

Throughout Latin America, governments can no longer rely on high commodity prices to help them finance key programs and projects, particularly related to infrastructure. So I think reforms are going to be very important. Energy reform in Mexico has opened up the oil sector to private investment through different participation schemes. Previously, the state-owned enterprise Pemex was the only firm that was allowed to capitalize on oil resources. Now, the newly established National Hydrocarbons Commission has the authority to auction fields to private parties. The commission has conducted three auctions so far, and each was more successful than the previous one, with the most recent auction securing a 100% assignment rate. The onshore fields already auctioned have low costs and have been profitable even at currently low oil prices. In addition to these auctions, Pemex will be able to partner with specialized oil players to develop its existing resources. The government is currently working on the rules governing the Mexican equivalent of a US master limited partnership (MLP) that will be used to list energy assets from Pemex and private parties. We believe all of these developments will likely lead to an increase in foreign direct investment.

Source: Why We Think Mexico Is a Standout in Latin America by Rodolfo Ramos Cevallos, Templeton Emerging Markets Group

Ways to invest in Mexican stocks:

One way to gain exposure to Mexican equities is via the iShares MSCI Mexico Capped (EWW) ETF. Current the fund has an asset base of over $1.0 billion.

Some of the Mexican ADRs that investors can consider include: Fomento Economico Mexicano SAB de CV (FMX), America Movil (AMOV), Coca-Cola Femsa (KOF), Kimberly Clark de Mexico (KCDMY), Grupo Aeroportuario del Sureste (ASR), Grupo Aeroportuario del Pacifico(PAC), etc. The full list of Mexican ADRs can be found here.

Notes:

1. Source: MCSI. The MSCI Emerging Markets Index captures large- and mid-cap representation across 23 emerging market countries; the MSCI Latin American Index captures large- and mid-cap representation across five emerging market countries in Latin America. The MSCI Mexico Index is designed to measure the performance of the large- and mid-cap segments of the Mexican market. Indexes are unmanaged, and one cannot directly invest in an index. They do not reflect fees, sales or expense charges. Past performance is no guarantee of future results.

2. Source: Mexican Auto Industry Association (Asociación Mexicana de la Industria Automotríz), based on 2014 data.

3. Ibid. There is no assurance that any estimate or forecast will be realized.

4. There is no assurance that any estimate or forecast will be realized.

5. Sources: Energy Information Administration, Bank of Mexico, based on 2014 data.

6. Source: El Economista, March 2016.

7. Based on the Consumer Price Index.

Disclosure: No Positions