The number of publicly-listed companies are much higher in foreign markets than in the US markets. So foreign stock markets provide a fertile hunting ground for stock pickers. US investors restricting them to domestic companies lose out on many of these potential opportunities.

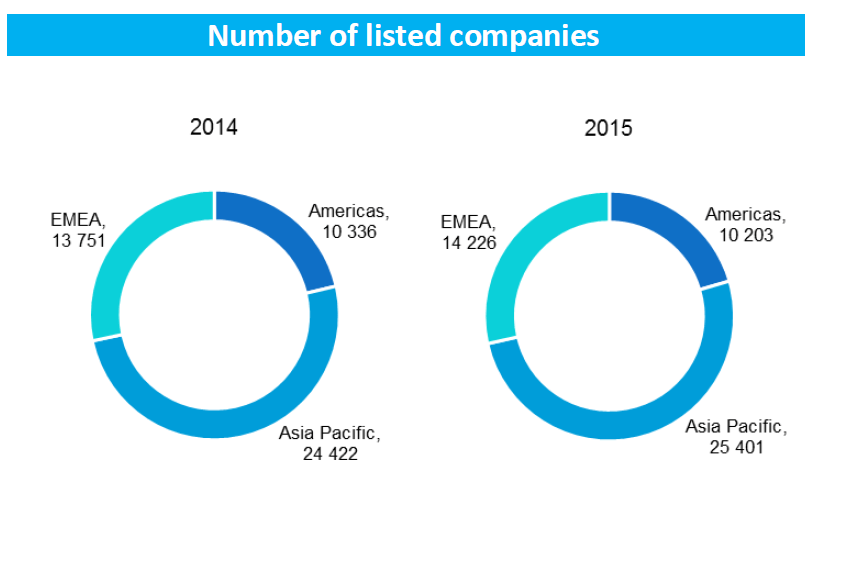

The chart below the total number of listed companies in the world at the end of 2015:

Click to enlarge

Source: 2015 Market Highlights, World Federation of Exchanges

Asia-Pacific has the highest number of listed firms followed by Europe, Middle East and Africa (EMEA).

In the US, NYSE has about 2600 firms listed including some foreign issuers. As of Dec 31, 2015, 513 foreign companies are listed on the NYSE. NASDAQ has about 3300 firms (including some foreign companies) listed.In addition, hundreds of foreign stocks can be accessed via the OTC markets.

However many foreign companies are not listed on the US exchanges or traded on the OTC markets. By going abroad one can access many of these foreign firms.

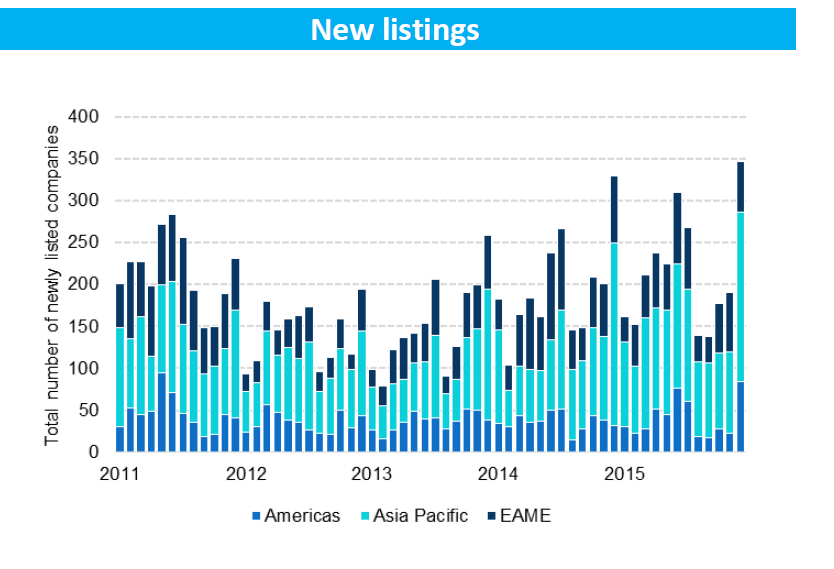

In IPO listings also, foreign markets especially those in the Asia-Pacific have more listings recently than other regions as shown in the chart below:

Click to enlarge

Source: 2015 Market Highlights, World Federation of Exchanges

Key Takeaway:

Instead of purely focusing on US stocks, investors can explore their horizon and expand their investment universe by venturing into far away countries.