Holding dividend-paying stocks to hold in a well-diversified is a wise strategy. This is especially important for investors who focus on long-term goals such as retirement, paying for college, etc. I have written many times before on the advantages of dividend payers over non-payers.

Investing in non-dividend stocks purely for price appreciation is not for the faint of heart. For example, Chipotle Mexican Grill, Inc. (CMG), a non-dividend payer plunged from over $758 to as low as $399 a while ago when customers fell ill after eating in its restaurants. Though it has recovered to $511 now, stocks such as Chipotle are not high-quality stocks that long-term investors must hold. In addition to not paying a dividend, Chipotle is riding the wave of a fad for fast-casual food fad.

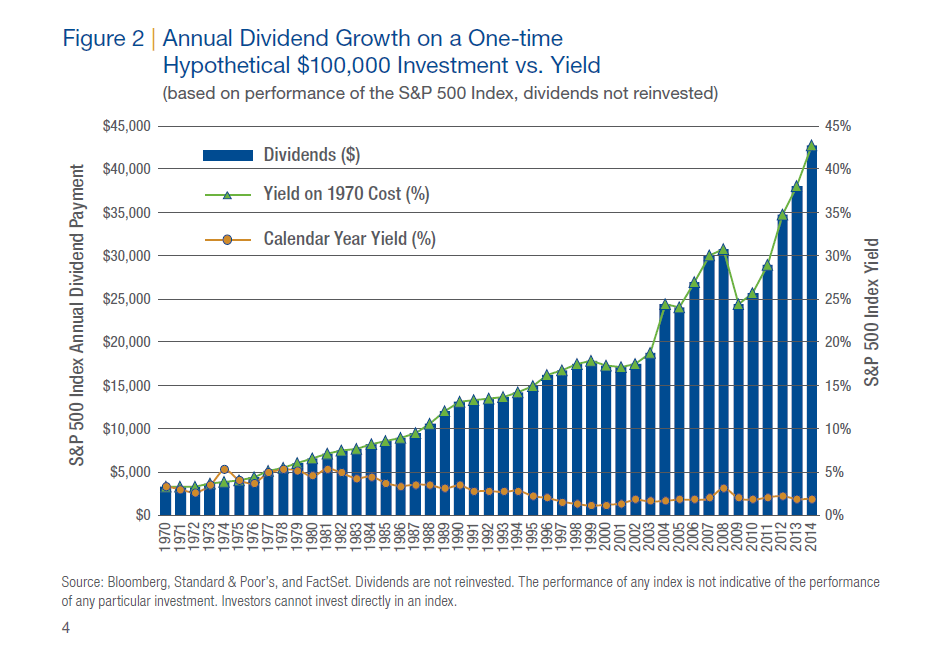

Dividend stocks can not only provide steady income but also offer dividend growth that can beat inflation. A single hypothetical share of the S&P 500 Index offered $5.65 in dividends in 1979. Since then annual dividend yields on the S&P 500 has been decline. Even with the decline, the annual dividends has grown to $39.44 in 2014 according to a research report by Thornburg Investment Management. This assumes that the dividends each year were not reinvested. If those dividends had been reinvested, then the amount of income earned in 2014 would have been higher.

Click to enlarge

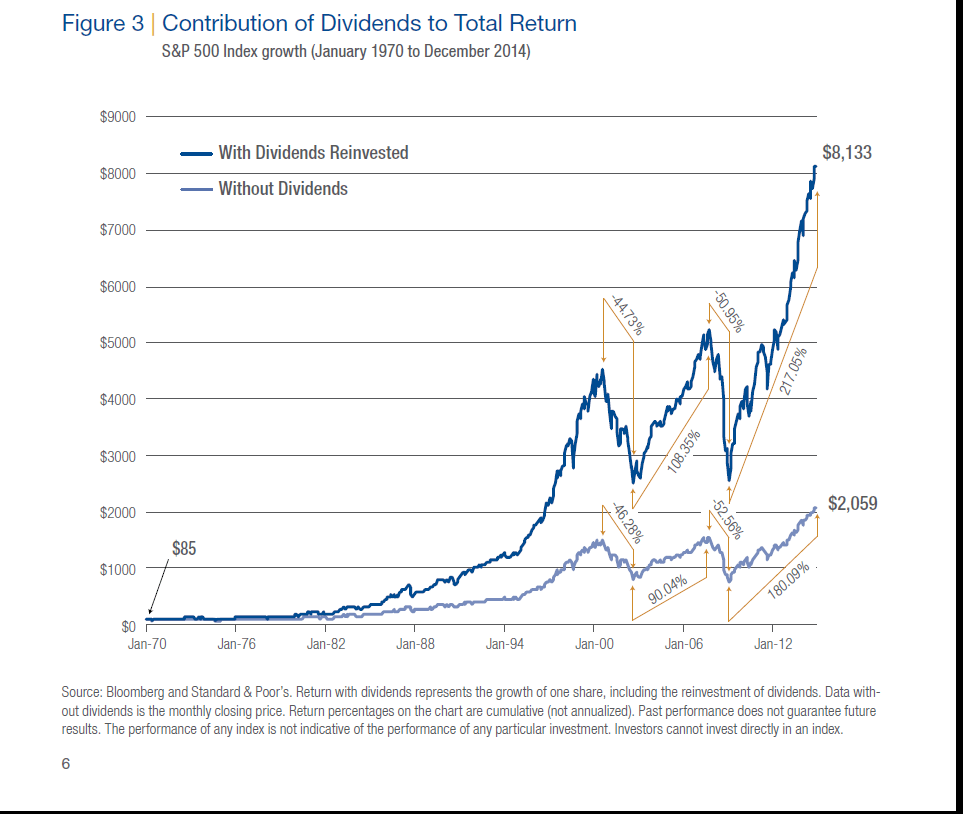

Dividends account for a huge portion of total returns over time as shown in the chart below:

From the research report:

As Figure 3 shows, the S&P 500 Index did very well from January 1970 through December 2014, even without accounting for dividends. One share of the S&P 500 Index grew to $2,059, an annualized return of 7.40%.

However, one can see that the additional return generated by reinvesting those dividends would have dwarfed the return earned by simple price appreciation. By continually accumulating additional shares through reinvesting dividend payments, the S&P 500 Index would have grown to over $8,133 by December 31, 2014, an annualized return of 11.01%.

Source: Cultivating the Growth of the Dividend, Thornburg Investment Management

Disclosure: No Positions