Oil prices have declined dramatically in the past year and continue to fall further. West Texas Intermediate crude is trading at around $36 a barrel compared to over $50 a while ago. Last week crude prices reached the lowest level in six years. A confluence of factors are attributed to the oil price collapse some of which include:

- Global supply glut

- Demand is still growing but supply-side pressures keep hurting the price

- OPEC decided to not cut production levels

- US shale oil producers are flooding the market

- Oil held in reserves including the strategic reserves held by the US and oil floating in storage ships on seas are at high levels

- Saudi Arabia not cutting production

Up until a few months ago it appeared that $50 was the floor for oil But now analysts that predicted $150 or even $200 a barrel a few years ago are predicting $35 or even $20 per barrel. In reality, nobody knows what the price of oil would be next year this time.

With that introduction of the current state of the oil market, lets take a look at the performance of the exchange-traded foreign oil sector stocks. The table below shows the year-to-date(YTD) price returns:

| Company | Symbol | Last Price in $ | YTD %Chg | |

|

SSN | 0.53 | 165.00% | |

|

TGS | 5.73 | 63.71% | |

|

PZE | 5.17 | 4.66% | |

|

TOT | 45.26 | -11.60% | |

|

E | 29.41 | -15.75% | |

|

STO | 14.06 | -20.16% | |

|

BP | 30.22 | -20.72% | |

|

CEO | 100.75 | -25.61% | |

|

SNP | 55.91 | -30.98% | |

|

RDS.A | 43.95 | -34.35% | |

|

SSL | 24.86 | -34.53% | |

|

RDS.B | 44.38 | -36.20% | |

|

PBR | 4.5 | -38.36% | |

|

YPF | 15.9 | -39.93% | |

|

PTR | 64.68 | -41.71% | |

|

PBR.A | 3.68 | -51.45% | |

|

CGG | 2.71 | -54.07% | |

|

EC | 6.5 | -62.03% |

Source; BNY Mellon

Three observations on the above table:

- Colombia’s Ecopetrol (EC) is the worst performer with a loss of 62%, Just recently the stock traded at about $13. Now it has plunged to $6.50.

- Petrobras (PBR) of Brazil is bogged down in the ongoing corruption scandal. Hence the stock price is depressed. It may take many months for the company to sort out the issues. In addition, the current crude oil prices does not help Petrobras.

- Integrated oil majors such as BP(BP), Total(TOT), Statoil(STO), Royal Dutch Shell – A Shares(RDS-A) and Royal Dutch Shell – B Shares(RDS-B) are better for dividend investors as they have strong cash flows to cover dividend payouts and should be able to wither this downturn in oil prices.

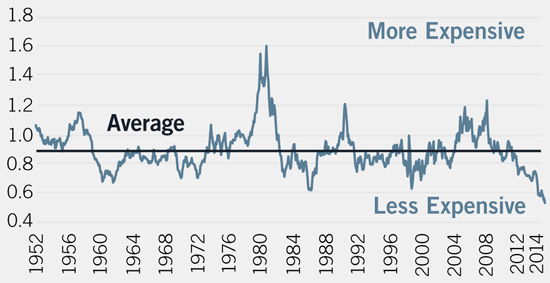

On a related note, an article at Fidelity notes that energy stock valuations are at a historical lows:

Click to enlarge

Data shown represents price-to-book (P/B) ratio of energy stocks relative to the P/B ratio of the largest 1,500 U.S. stocks, weighted by market capitalization. Dotted lines: Relative P/B forecasts. Source: Corporate reports, Empirical Research Partners, as of Sep 30, 2015.

Source: 2016 outlook: energy, Fidelity

Though valuations are attractive for energy firms, plenty of risks remain should oil prices decline more. So caution is needed when picking stocks in this sector. Investors may want to avoid small risky Exploration & Production (E&P) companies and stick with large-cap firms with strong cash flows. Unlike the big guys smaller guys may get wiped out if the market deteriorates.

Disclosure; Long EC, PBR