Schroders, a UK-based Asset Manager, is bullish on European stocks for 2016. In the Outlook 2016: European Equities report published on November 24th, Rory Bateman, Head of UK & European Equities noted:

At the time of writing, the MSCI Europe equity index has delivered a total return of around 10% this year and we believe investors should see further gains in 2016 given the continued earnings recovery in Europe.

After years of under-performing other developed countries, European economies are well positioned to catch up. Already this year, major European market indices are ahead of the benchmark US indices.

From the report:

Scope for profit margins to improve

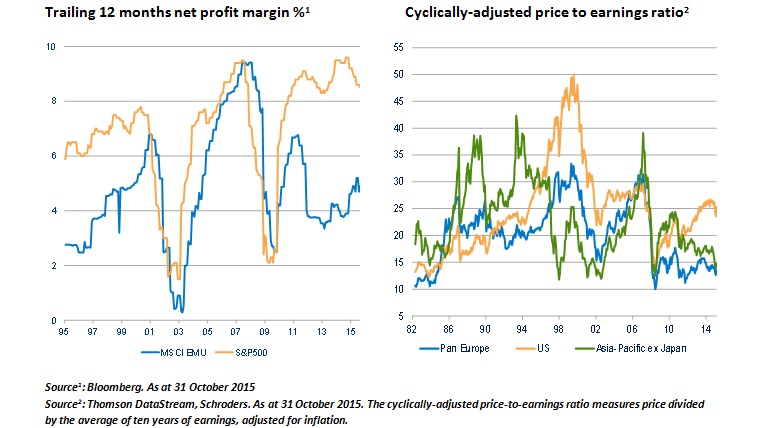

Corporate profit margins within the eurozone particularly remain at depressed levels relative to the US.

This gap has been significant since the global financial crisis and a narrowing of the disparity would support European shares.

At the same time, valuations are compelling versus historical levels and most other equity markets.

Click to enlarge

Source: Outlook 2016: European Equities, Schroders

Based on the P/E ratio shown above, US stocks are expensive now and European stocks are cheaper on a relative basis and historical basis.

So investors looking to gain exposure to Europe can consider adding equities in the cyclical and defensive sectors. Cyclical stocks tend to perform well at the start of the economic recovery phase and growth stocks are good to hold when recovery is well underway. Cyclicals by definition grow and fall with the state of the economy.

Five European stocks are listed below with their current dividend yields for further research:

1.Company: Danone SA (DANOY)

Current Dividend Yield: 2.45%

Sector:Food Products

Country: France

2.Company: BASF SE (BASFY)

Current Dividend Yield: 3.77%

Sector:Chemicals

Country: Germany

3.Company: adidas AG (ADDYY)

Current Dividend Yield: 1.78%

Sector:Textiles, Apparel & Luxury Goods

Country: Germany

4.Company: Safran (SAFRY)

Current Dividend Yield: 1.91%

Sector:Aerospace and Defense

Country: France

5.Company: Edp Energias De Portugal SA (EDPFY)

Current Dividend Yield: 6.17%

Sector: Electric Utilities

Country: Portugal

Note: Dividend yields noted above are as of Nov 30, 2015. Data is known to be accurate from sources used.Please use your own due diligence before making any investment decisions.

Disclosure: No Positions