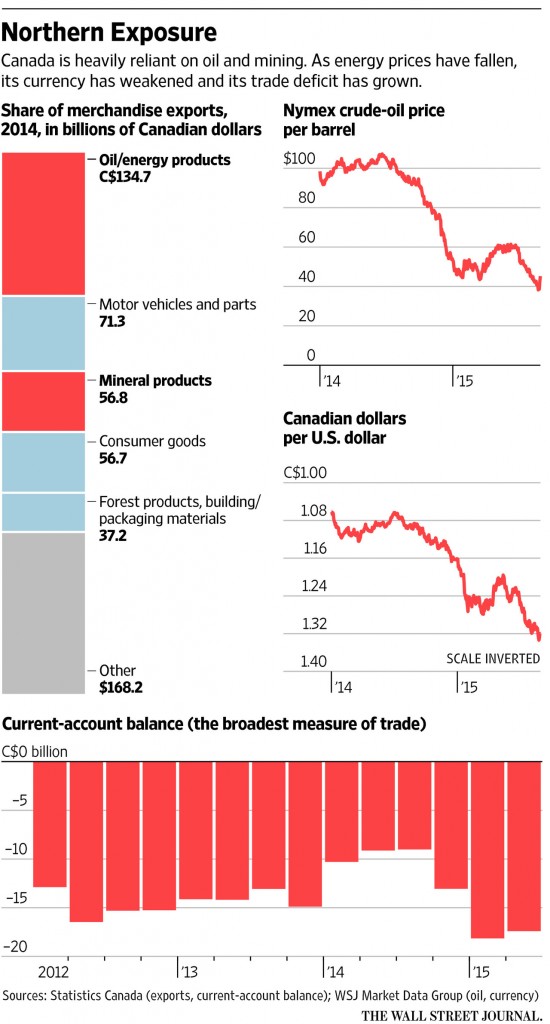

Canada is primarily a resource-based economy with oil and minerals accounting for a major source of export revenue. As the price of oil plunged in the past year or so, commodity-based economies such as Brazil, Russia, Australia, Canada, etc. are suffering. After being resilient for a few months, the Canadian economy has now officially entered recession. From a recent article in the BBC:

The Canadian economy has entered recession, official figures have shown.

Gross domestic product (GDP) fell by an annualised rate of 0.5% between April and June.

That follows a contraction of 0.8% in the first quarter, meaning the economy has seen two consecutive quarters of negative growth, the usual definition of recession.

Source: BBC

The Journal published an article today on the Canadian economy and natural resources-based economies in general. From that piece:

Click to enlarge

In Canada, the oil-price collapse and recent market turmoil have pushed its dollar down to 11-year lows against that of the U.S., its biggest trading partner. Policy makers have pointed to the lower dollar as the silver lining of the commodities rout, since it is expected to help manufacturers and exporters.

But the manufacturing sector, concentrated in Quebec and Ontario, was hollowed out during the years the Canadian dollar traded at or near par with the U.S. dollar, and by the recession that followed the financial crisis.

Now many economists say Canada is no longer competing with the U.S. to regain factory jobs. Instead, both Canada and the U.S. are losing those jobs to lower-cost Mexico.

Source: Canada Illustrates Plight of Rich but Resource-Dependent Countries, Sept 2, 2015, WSJ

Though the economy is in contraction mode now, Canada offers many opportunities for investment in select sectors. Here are a few positive factors the Canadian economy:

The banking industry is very strong and is highly regulated. Though a handful of banks dominate the industry is much better than the US banking industry for a variety of reasons. For example, concepts such as sub-prime mortgages or NINJA (No Income No Job No Assets) loans are virtually unheard of in Canada. In addition, all mortgage loans are recourse loans – meaning the lender can after a defaulted borrower to recover the full amount of a loan – and borrowers can mail in the keys and escape free.

As the chart above shows, automobile and parts manufacturing is also a big industry especially in the provinces of Ontario and Quebec. The U.S. is Canada’s largest trade partner and one of the big exports category to the U.S. is automobiles. Hundreds of Canadians are employed in this industry and American auto makers prefer Canada in some ways over Mexico. For instance, unlike in the U.S. auto makers benefit tremendously from not having to offer healthcare benefits to Canadian workers since the state offers universal healthcare to all. In the US, healthcare costs is a major drag for auto makers.

Railroad is another industry that investors can consider for long-term investment. With just two railroads dominating the entire industry in the country, it is a no-brainer to invest in them. Though oil shipments may have slowed, rails are still the preferred means of transport for agricultural, timber and automobiles. Hence railroad operators will benefit from a growing US economy.

From an investment point of view, investors may consider adding Royal Bank of Canada(RY) and Toronto Dominion Bank(TD) in the banking sector, railroad operator Canadian National (CNI) and auto-parts maker Magna International(MGA)

Disclosure: Long RY,TD,MGA, CNI