Most major developed countries charge some of taxes on Financial Transactions. After the Global Financial Crisis(GFC) of 2008-09 some of the countries introduced new taxes in an effort to discourage rampant speculation. However the Financial Transactions Tax(FTT) has been a failure in some countries such as Sweden. The FTT varies widely between countries and also on asset classes.

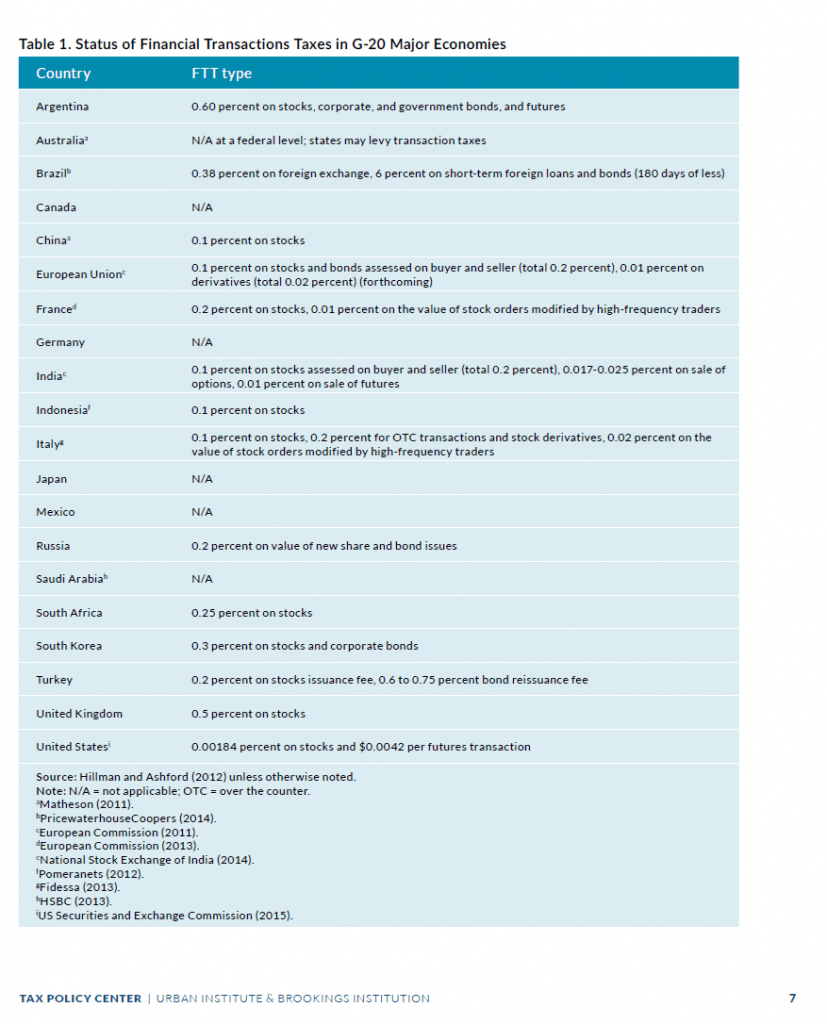

The following table lists the latest FTT rates on major G-20 economies:

Click to enlarge

Source: FINANCIAL TRANSACTION TAXES IN THEORY AND PRACTICE by Leonard E. Burman, William G. Gale, Sarah Gault, Bryan Kim, Jim Nunns, and Steve Rosenthal, June 2015 (Updated July 31, 2015), Tax Policy Center

France:

“The French President Francois Hollande has introduced a tax on financial transactions effective August 2, 2012. This tax of 0.2% applies on all stock purchases of publicly traded French companies with market capitalization of over over one billion Euros.” The list of French ADRs impacted by this tax can be found here.

The 0.2% tax rate is too high and makes French companies unattractive for global equity investors. At some point in the future, this tax rate will probably be repealed.

Italy:

Following France, Italy introduced the FTT in March 2013.

UK:

UK has had the “stamp duty” on purchase of stocks issued by British firms. This tax, first enacted in 1694, currently stands at 0.50%. This tax brings an easy £3 billion per year to the state.

US:

The FTT rate on is 0.00184 percent on sale of securities. This fee is usually deducted by brokerages from the sale proceeds.