Many years ago I wrote an article comparing the capital gains tax rate between the U.S. and other countries. In this post lets review how the dividend tax rates differ among select countries.

Generally it is assumed that dividend taxes are paid by equity holder only.However that is not true. Taxes on a company’s profit are paid in two ways: first by the company itself in the form of corporate taxes and then by the stock holder in the form of dividend taxes, assuming the company pays dividends. Hence there are two layers of taxes on dividends. Accounting form calls these two taxes combined as “Integrated Dividend Tax Rate”. This allows for easier comparison of this tax rates between countries.

Here is an example of how this Integrated Dividend Tax Rate is calculated for U.S firms based on 2014 rates:

Company: Abra Cadabrra Corporation

Street: 1234 Heaven on Earth Avenue, Suite #47

City: Truth Or Consequences

State: New Mexico

Zip Code: 87901

Corporate Income Tax:

Pre-Tax Corporate Earnings of: $100

Top Corporate Tax Rate: 39%

Corporate Taxes Paid: $39.00

So Pre-Tax Corporate Earnings: $61.00

Assume that this amount is paid to shareholders as dividends.

Individual Income Tax:

Federal Taxes on Dividends: $14.52 (i.e. based on Top Federal Dividend Rate of 20% and Medicare Tax of 3.8% on $61.00)

Average Top State Income Taxes: $2.71

So Total Taxes paid by the stockholder: $17.23

Hence the total taxes paid to the government by the company and the stockholder: $56.23 (i.e. $39 + $17.23)

The Top Integrated Dividend Tax Rate: 56.2%

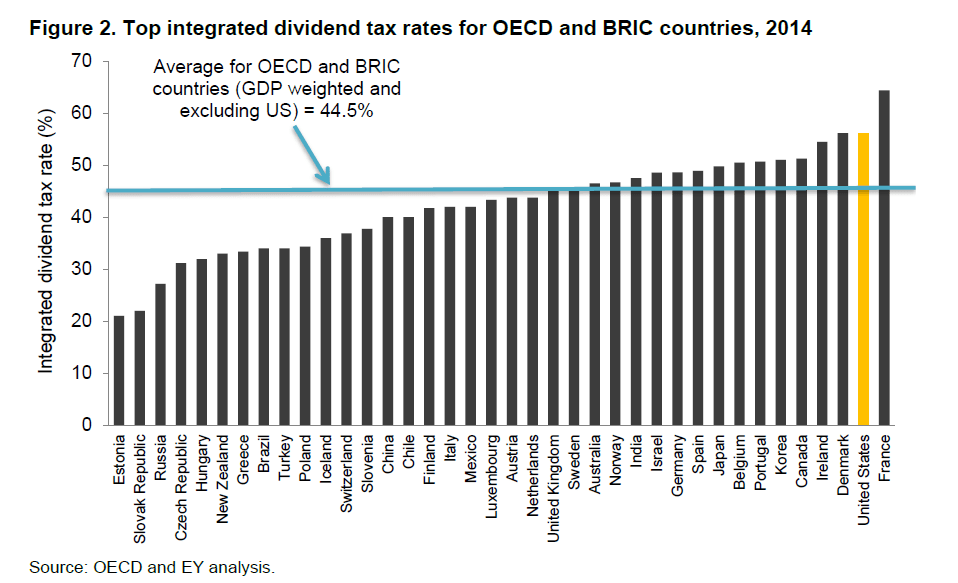

The U.S. has the second highest Integrated Dividend Tax Rate in the world as shown in the chart below:

Click to enlarge

Source: Corporate dividend and capital gains taxation: A comparison of the United States to other developed nations, April 2015, Alliance for Savings and Investment (ASI)

Of all the countries listed above, only socialist France is the worst compared to the capitalist U.S. based on the above measure.

The top U.S. rate of 56.2% is 11.7% higher than the 44.5% for the OECD and BRIC GDP-weighted average (excl. US). This difference is in fact huge.

From the ASI research report:

Most other developed nations provide at least some relief from the double tax, and many have done so for decades. Although the form of relief varies, it is often provided at the shareholder level through three different approaches: a dividend exclusion, lower tax rates, or an imputation credit, whereby shareholders receive a credit for taxes previously paid at the corporate level.10 In recent years, some countries have reduced shareholder relief as they have reduced statutory corporate income tax rates.

As shown in Figure 2, among the 34 OECD and four BRIC nations in 2014, the United States has the second highest top integrated dividend tax rate (56.2%), exceeded only by France (64.4%). 11

Prior to 2003, the United States had a top integrated dividend tax rate that was far above that in most other developed nations. The top US integrated dividend tax rate was 66.5% in 2000, as compared to a GDP-weighted average of 60.2% among the G-7 nations (excl. US) and 56.6% among OECD nations (excl. US).

Note:

10 Under an imputation credit shareholders gross up their dividend by the corporate tax rate (i.e., the dividend divided by one minus the corporate tax rate) to compute the gross dividend. The taxpayer then claims the allowed credit. A full imputation system would completely eliminate the corporate level tax, while a partial credit would eliminate just part of the corporate level tax.

11 The OECD is the Organisation for Economic Co-operation and Development. BRIC countries include Brazil, Russia, India, and China.

Australia is one country which provides tax relief to shareholders via the imputation credit method. Dividends by paid by Australian firms are considered as “Franked Dividend”. This means have they have franking credits attached to them. Basically this method prevents the double taxation of dividends. As discussed before, in the U.S. dividend taxes are paid by both the company and the individual stockholder. As a result Uncle Sam effectively double dips on all profits earned by a company.

Here is a good explanation of the Franked Dividend concept in Australia:

Dividends are paid out of profits which have already been subject to Australian company tax which is currently 30%. This means that shareholders receive a rebate for the tax paid by the company on profits distributed as dividends.

These dividends are described as being ‘franked’. Franked dividends have a franking credit attached to them which represents the amount of tax the company has already paid. Franking credits are also known as imputation credits.

You are entitled to receive a credit for any tax the company has paid. If your top tax rate is less than the company’s tax rate, the Australian Tax Office (ATO) will refund you the difference.

Case study: James receives a tax refund

James owns shares in a company. The company pays him a fully franked dividend of $700. His dividend statement says there is a franking credit of $300. This represents the tax the company has already paid. This means the dividend, before company tax was deducted, would have been $1,000 ($700 + $300).

Come tax time, James must declare $1,000 (the $700 dividend plus the $300 franking credit) in his taxable income. If his marginal tax rate was 15%, he would have paid $150 tax on the dividend. Because the company has already paid $300 in tax, James will receive a refund of the difference, which is $150.

Source: How do franking credits work?, Commonwealth Bank of Australia