In 2014, the U.S. equity markets had an excellent year with the S&P 500 rising 13.69% including dividends. This year the performance of the index has been average so far. Since the lows attained during the Global Financial Crisis in 2009 the S&P 500 has shot up and has more than doubled. From 2009 thru 2014 except in 2011, the annual total return of the index every year was in double digits. With such great returns year after year investors may be tempted to believe that stocks generally yield 10% or more every year. However that is not true. Equities are unlikely to generate such high returns every year if the past is any indication.

From an article by Niels Jensen of Absolute Return Partners:

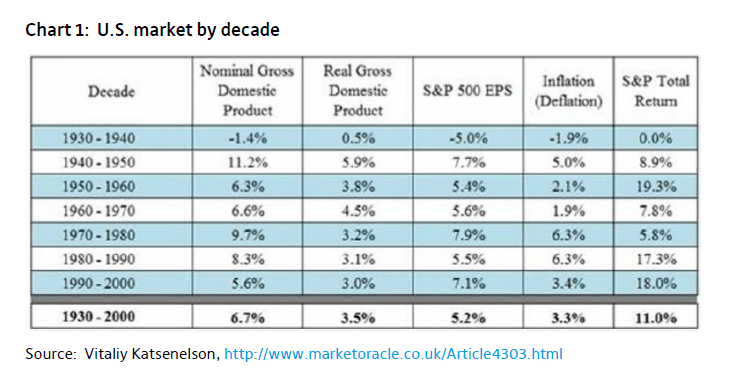

Academics operate with an expression called recency. It basically means that we, as humans, assign greater relevance and importance to more recent events than we do to more distant ones. When equities delivered exorbitant returns during the great bull market of 1982-2000, it became the norm to expect double digit returns from equities, despite the fact that equities had rarely delivered such high returns before the 1980s (chart 1).

Click to enlarge

The combination of high debt and deteriorating demographics will almost certainly lead to below average economic growth over the next 5-10 years, and with comparatively low economic growth, low earnings growth will follow. Any other expectation is entirely unrealistic. Now is not the time to be expecting double digit equity returns.

Obviously, rising P/E multiples could still result in decent equity returns, and modestly rising multiples are precisely what I need for the equity market to generate mid-single digit annual returns over the next several years. (For the record, that expectation is driven primarily by the very low interest rates environment.) I just don’t think the multiple expansion is going to be massive, given the very strong headwinds I mentioned earlier.

Source: Tigers in Africa, March 2015, The Absolute Return Letter, Absolute Return Partners

So it is important to remember that returns from equities will be muted moving forward and based on past data and investors have to adjust their expectations accordingly.Double digit returns every year is unlikely.

Related ETF:

- SPDR S&P 500 ETF (SPY)

Disclosure: No Positions

Also checkout:

From an article on this topic from The Wall Street Journal:

In early January, financial adviser Winnie Sun sat down in her Irvine, Calif., office with a prospective client whose net worth topped $350 million. As they talked, the client told Ms. Sun he expected to make 20% a year in the stock market.

Ms. Sun was taken aback. That is twice the average annual return of the S&P 500 since 1925, once dividends are included.

“I said, ‘I think the main thing you need to realize is that in the past there were extraordinary times when we had great returns but to expect that in the next few years is impractical and somewhat delusional,’ though I didn’t say delusional,” said Ms. Sun, a founder of Sun Group Wealth Partners, with $160 million of assets under management.

The investor, who was in his late 20s and newly wealthy, left the meeting quietly. He reached out to Ms. Sun a week later to tell her he appreciated her frank response but hasn’t put money with the firm.

Investors have reason to expect a lot from stocks. On average, the S&P 500 has returned 18% a year since 2009, including dividends, and from the start of 2012 the index’s total return has averaged 21% a year. That is the S&P 500’s best three-year period since the tech bubble era of 1997 through 1999. Total returns reflect price changes and dividends.

Advisers like Ms. Sun, said that as the bull market rolls into its sixth year, there has been a shift from the dour outlook that followed the financial crisis, in which they often had to cajole clients to keep their money in stocks.

Some advisers said they now have the opposite problem: They have to counter expectations for stock-market returns that are well above long-term averages and fend off demands that advisers put more money into U.S. stocks than the advisers feel is appropriate.

Source: As Bulls Romp, Advisers Aim to Manage Down Expectations, Mar 9, 2015, WSJ