Jack Bogle, the founder and former CEO of The Vanguard Group gave an interview to Bloomberg’s Carla Fried earlier this month. His views on investing in markets outside of the U.S. is wrong for many reasons. I will discuss two such reasons below.

From the interview:

You’ve often reminded investors that what’s done well in the past probably won’t do well in the future. So for a patient investor with a long horizon, where should they be investing today?

I like the U.S. The U.S. is the most productive country in the world. It is the most rapidly growing of the industrialized nations, other than Switzerland. We still have plenty of problems, but we’re much better than France, Britain and Germany. And we don’t even want to talk about Italy and Greece. And importantly — people forget this too quickly — we have the most established government and legal institutions.

When you look at global market capitalization it’s true that the U.S. accounts for about 48 percent and other countries 52 percent. But the top three markets outside the U.S. are the U.K., Japan and France. What’s the excitement about there? Emerging markets have great potential, but have fragile sovereigns and fragile institutions.

I wouldn’t invest outside the U.S. If someone wants to invest 20 percent or less of their portfolio outside the U.S., that’s fine. I wouldn’t do it, but if you want to, that’s fine.

Have you ever invested in international markets?

Not really. Other than when I had small amounts when we launched [Vanguard] International Growth and the [Vanguard] International Index fund, I had small investments in both. It’s hard to believe that the differences in returns over the long term will be huge. That’s just not what we have seen for the most part. Why take the currency risk?

Source: Jack Bogle: I Wouldn’t Risk Investing Outside the U.S., Dec 9, 2014, Bloomberg

U.S. investors should invest a portion of their portfolio on foreign stocks.They can invest via stocks of foreign companies trading on the U.S. markets, a mutual fund, an ETF or directly in foreign equity markets if they can access them. Despite the currency risk that Mr.Bogle mentioned and many other risks there are many advantages to investing in overseas stocks.

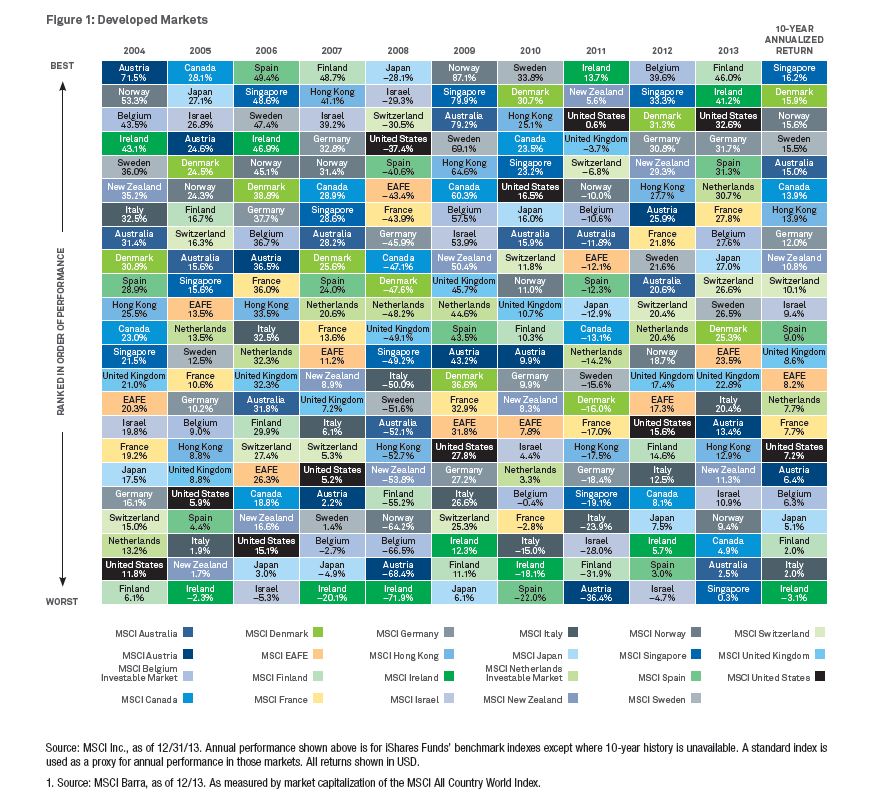

1. Diversification: By excluding foreign stocks one loses the benefits of diversification. Diversification is one way to reduce risk.Including foreign stocks in their portfolios helps reduce risk. For example, though the U.S. stocks have done very well in 2013 and this year, there is no guarantee they will continue to outperform other markets in the future. No country has been the top performer consistently every year as shown in the following Periodic Table of Investment Returns for Developed Markets 2013:

Click to enlarge

Source: Blackrock

2. Many foreign markets have dividend yields that are much higher than the yields for the U.S. market. So even after accounting for currency risks and dividend withholding taxes one can earn a higher return by investing in foreign stocks. As of Dec 22, the dividend yield for the U.S. equities is 1.9% compared to 3.3%, 2.9%, 4.9 for UK, Canada and Norway according to FT Market Data.

Related ETFs:

- iShares MSCI Canada Index (EWC)

- iShares MSCI Australia Index (EWA)

- Global-X Norway ETF (NORW)

- iShares MSCI United Kingdom Index (EWU)

Disclosure: No Positions