Up until a few decades ago the term “Multi-National Company” or MNC generally represented Western companies that were true multinationals and operated across the globe. In the recent decades, as emerging countries such as Brazil, Russia, India and China grew stronger economically some of firms from these countries emerged as the new emerging multinationals. A few of these multinationals include Petrobras (PBR) of Brazil, Gazprom(OGZPY) of Russia, Infosys (INFY) of India and China Petroleum & Chemical Corp.(SNP) of China.

Following the footsteps of emerging multinationals, some of the companies in frontier markets are also growing not only domestically but also expanding in markets outside of their home territories. These Frontier Markets Multinationals (FMMs) are have many advantages relative to their developed world peers according to an article by Tomás Guerrero, ESADE Business School in FT beyondbrics blog.

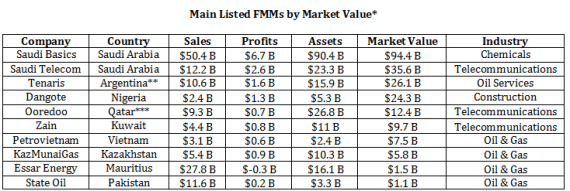

The table below shows the Top 10 Frontier Markets Multinationals (FMMs):

Click to enlarge

Source: Guest post: frontier market multinationals propel growth, FT beyondbrics, Oct 10, 2014

The author noted that the MSCI Frontier Markets Index rose by 26.3% in 2013 compared to the Emerging Markets Index which lost 2.6%.

As most of the frontier market firms do not trade on the US exchanges, one simple way to gain exposure to them is via the iShares MSCI Frontier 100 ETF (FM). Its 127 holdings includes companies such as Zain, Dangote, PetroVietnam, etc. noted in the table above.

The ETF has an asset base of over $786.0 million and the distribution yield as of Sept 30th is 4.69%. The expense ratio is 0.79%. Of the 16 countries represented in the fund, Kuwait, Nigeria and Argentina have the highest allocations.

Though the MSCI Frontier Markets 100 Index gained 26.33% last year, the returns in 2012 and 2011 were 8.60% and -18.63% respectively. While emerging markets performed poorly last year, developed markets performed well with the S&P strongly rising by double digit percentage points.So relative to the US market return last year frontier markets did not outperform by a huge margin.

The dividend yield on the MSCI Frontier Markets 100 Index which is tracked by the iShares MSCI Frontier 100 ETF (FM) was 3.62% at the end of last month. This is much higher than the S&P 500’s dividend yield of around 2.0%.

Frontier markets are not for the faint of heart. They are riskier than emerging markets. Generally frontier market stocks may not be suitable for most of the investors. However investors willing to take huge risks and diversify internationally can consider adding a very tiny part of their portfolio to these markets.Despite the huge gains in 2013 and the high dividend yield, the risks are far too high investing in places like Vietnam, Morocco, Nigeria, etc.

Disclosure: Long PBR