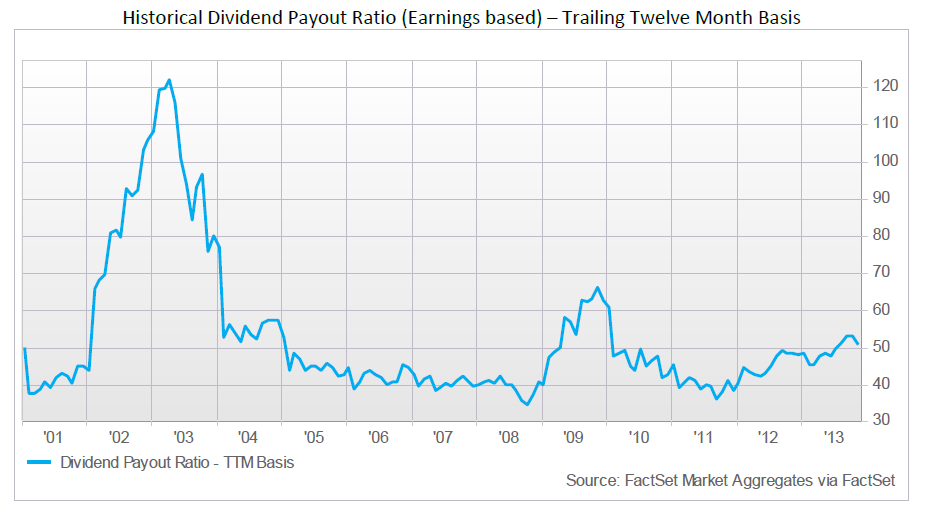

In an article last month I discussed about the continued decline in the dividend payout ratio of U.S. stocks. The following chart shows the historical dividend payout ratio of European stocks based on the MSCI Europe Index. This ratio mostly stays about 40% in Europe and is on an upward trend since mid-2011.

Click to enlarge

Source: FactSet Dividend Quarterly Europe: December 17, 2013, Factset

Ten of the top European dividend payers based on aggregate dividend amounts paid out to investors last year are listed below with their current dividend yields:

1.Company: Vodafone Group PLC (VOD)

Current Dividend Yield: 4.06%

Sector: Wireless Telecom

Country: UK

2.Company: Royal Dutch Shell PLC (RDS.B)

Current Dividend Yield: 5.16%

Sector: Oil, Gas & Consumable Fuels

Country: UK

3.Company: Total SA (TOT)

Current Dividend Yield: 4.80%

Sector:Oil, Gas & Consumable Fuels

Country: France

4.Company: Nestle SA (NSRGY)

Current Dividend Yield: 3.38%

Sector: Food Products

Country: Switzerland

5.Company: Roche Holding AG (RHHBY)

Current Dividend Yield: 3.23%

Sector: Pharmaceuticals

Country: Switzerland

6.Company: HSBC Holdings PLC (HSBC)

Current Dividend Yield: 4.92%

Sector: Banking

Country: UK

7.Company: BHP Billiton Ltd (BHP)

Current Dividend Yield: 4.34%

Sector:Metals & Mining

Country: UK

8.Company: GlaxoSmithKline (GSK)

Sector:Oil, Gas & Consumable Fuels

Current Dividend Yield: 6.02%

Country: UK

9.Company: Novartis AG (NVS)

Current Dividend Yield: 2.05%

Sector: Pharmaceuticals

Country: Switzerland

10.Company: BP PLC (BP)

Sector:Oil, Gas & Consumable Fuels

Current Dividend Yield: 5.56%

Country: UK

Switzerland has the highest dividend withholding taxes for US investors with a rate of 35%. Hence investors need to take this into consideration when investing in Novartis or other Swiss firms. On the other hand, dividends paid by British companies to US investors are not taxed by the UK . Hence British ADRs are attractive from a tax standpoint. However dividends paid to American investors by UK REITs will be taxed at 20%. This rate applies to both retirement and non-retirement accounts.

Note: Dividend yields noted above are as of Oct 10, 2014. Data is known to be accurate from sources used.Please use your own due diligence before making any investment decisions.

Disclosure: No Positions