Canada is the world’s second largest country in terms of land area. Unlike Russia which borders multiple countries, Canada is the only country in the world’s largest country that borders only one country according to CIA’s The World Factbook. The population of Canada is just 34.8 million making it the 38th in the world.

Canada is very rich in natural resources with an abundance of oil, natural gas, uranium, timber, etc. The Canadian economy is about $1.5 Trillion (based on 2013 estimates) in size. Canada’s largest trade partner is the U.S. Some of the major exports are autos and auto parts, timber, oil, natural gas, electricity, etc. Some of the major imports are machinery and equipment, chemicals, consumer goods, etc.

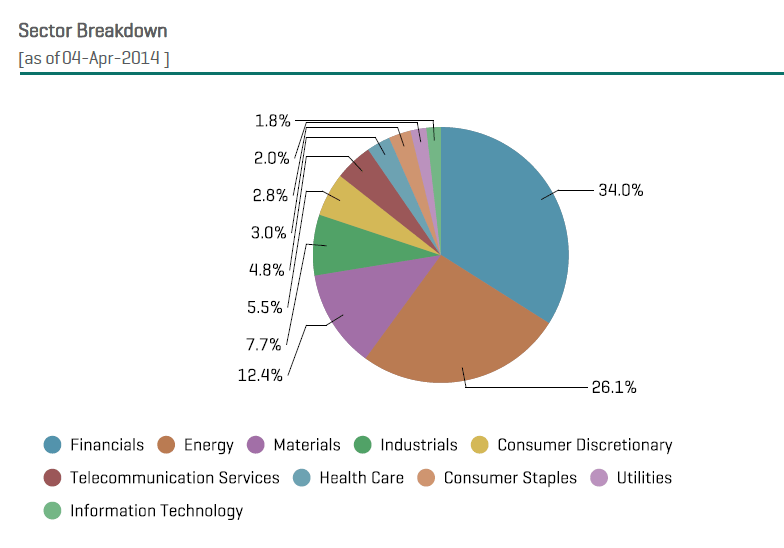

The S&P/TSX Composite is the benchmark equity index of Canada. There are 245 constituents in the index. The composition of the index by sector is shown below:

Click to enlarge

Source: S&P Dow Jones Indices

Financials is the largest sector in the index followed by energy and materials. As a “tree and rock” economy it is not surprising to see that these two sectors account for more than one-third of the index. In the past 5 years, the index has had a annualized price return and total return of 9.69% and 12.90% respectively according to S&P data.

The Top 10 Components of the Index are listed below with their current dividend yields:

1.Company: Bank of Nova Scotia (BNS)

Current Dividend Yield: 3.95%

Sector: Banking

2.Company: Bank of Montreal (BMO)

Current Dividend Yield: 4.10%

Sector: Banking

3.Company: Royal Bank of Canada (RY)

Current Dividend Yield: 3.90%

Sector: Banking

4.Company: Toronto-Dominion Bank (TD)

Current Dividend Yield: 3.65%

Sector: Banking

5.Company: Suncor Energy Inc. (SU)

Current Dividend Yield: 2.33%

Sector: Oil & Gas

6.Company: Canadian National Railway Co (CNI)

Current Dividend Yield: 1.63%

Sector: Industrials

7.Company: Canadian Natural Resources Limited (CNQ)

Current Dividend Yield: 2.06%

Sector: Oil & Gas

8.Company: Enbridge Inc. (ENB)

Current Dividend Yield: 2.76%

Sector: Oil & Gas

9.Company: Manulife Financial Corporation (MFC)

Current Dividend Yield: 2.45%

Sector: Insurance

10.Company: Valeant Pharmaceuticals International, Inc. (VRX)

Current Dividend Yield: No Dividends paid

Sector: Health Care

Note: Dividend yields noted above are as of Apr 4, 2014. Data is known to be accurate from sources used.Please use your own due diligence before making any investment decisions.

Disclosure: Long BNS, BMO, CNI, TD and RY