Some emerging markets offer decent dividend yields and the potential for higher dividend growth compared to developed markets. However when looking to invest in emerging market companies for income it is important to be highly selective. Not all emerging markets are worth investing in for dividends. One such market that investors must avoid is South Korea.

South Korea, together with Hong Kong, Singapore and Taiwan, were the four Asian Tigers whose economies grew rapidly between the early 1960s and 1990s. Today South Korea can be considered as a developed country just like Singapore is a developed country.But for technical reasons the leading index provider MSCI considers Korea as an emerging market. Their UK-based competitor FTSE assigns the developed country status to the country. Since MSCI is more commonly used lets go with Korea as an emerging market.

Currently the MSCI Emerging Markets Index has 824 constituents from 21 markets.South Korea is the second largest constituent in the index with a weight of about 16%. Just because MSCI has assigned such a high allocation to Korea it does not mean the market offers great opportunities for dividend investors.

Four reasons on why Korea is not the place to invest for dividends are discussed below:

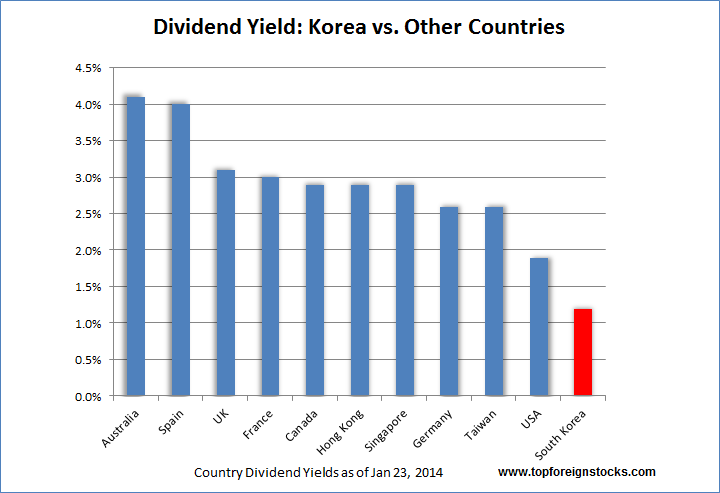

1. Korea has one of the lowest dividend yields relative to other countries as shown in the chart below:

Click to enlarge

Source: FT Market Data

Even China (not shown in chart) has a dividend yield of 4.6%. While the chart shows Korea has a dividend yield of 1.2%, most firms maintain their dividend yields at 1% or less.

2. The average payout ratio for Korean firms is just 12% compared to 31% for emerging markets as a whole.

3.The culture of paying dividends to shareholders is a low priority for Korean companies. This tradition is not going to chnage soon like in other emerging markets. For example, Samsung has a payout ratio of only 10%. Instead of increasing the dividend payout to shareholders, recently the company decided to pay about $1.0 billion in bonus to employees. Samsung has kept its dividend yield around 1% or less according to a Reuters report.

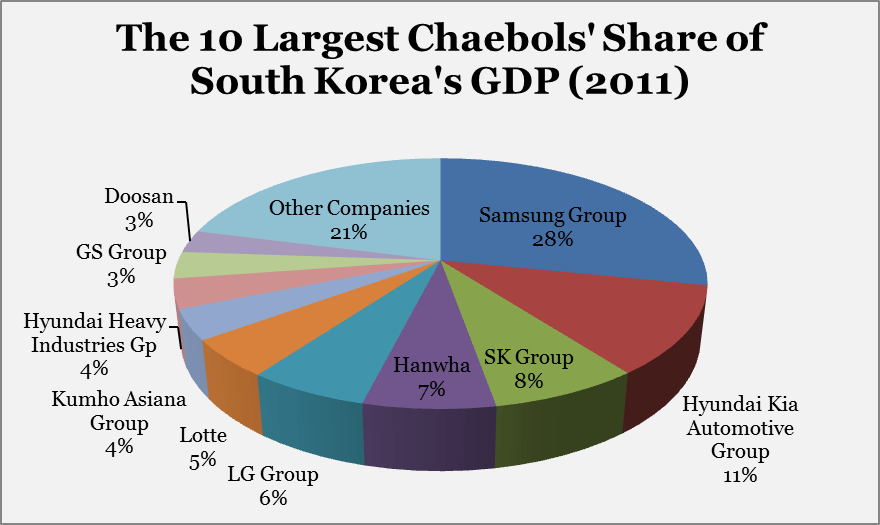

4.Korean companies have convoluted holding structures making it difficult for investors to find out if dividends will paid or not. For example, late last year a big block sale in the shares of SK Telecom hit the market but the seller was POSCO, the major Korean steel company.

Most Korean companies are part of chaebol which is similar to a conglomerate. One chaebol may have multiple companies under it.These chaebols are controlled by founding families and have complicated management structures. World-class Korean firms such as Samsung, Hyundai, LG, etc. are some examples of chaebols.

Click to enlarge

Chart Source: DayOnBay

Source: Emerging market income rewards selective investors, Emily Whiting, J.P.Morgan Asset Management, UK

The iShares MSCI South Korea Capped ETF(EWY) has a dividend yield of 1.41%. Of the nine Korean firms listed on the organized US exchanges, Korea Electric Power Corp. (KEP) is a unique case.As an utility one would expect the company to pay good dividends. But KEP’s dividend yield is 0%.The last time it paid a dividend was in 2005 !.

Disclosure: No Positions

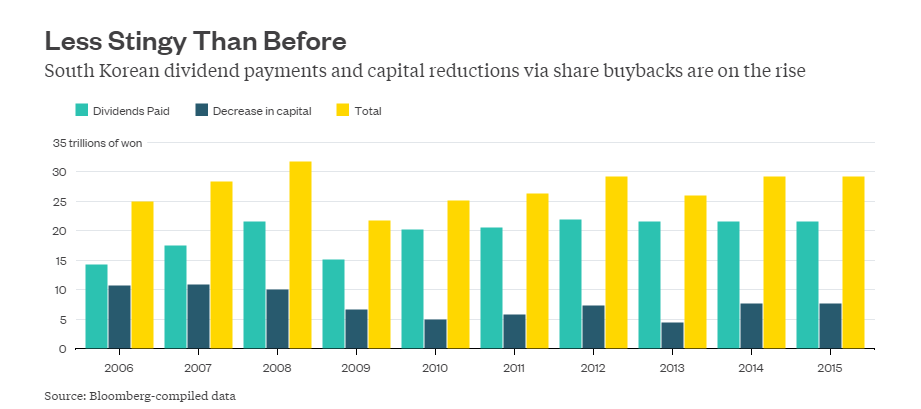

Update – 11/15/2015:

Click to enlarge

Source: It’s Payback Time for Korean Chaebol, Bloomberg, Nov 15, 2015