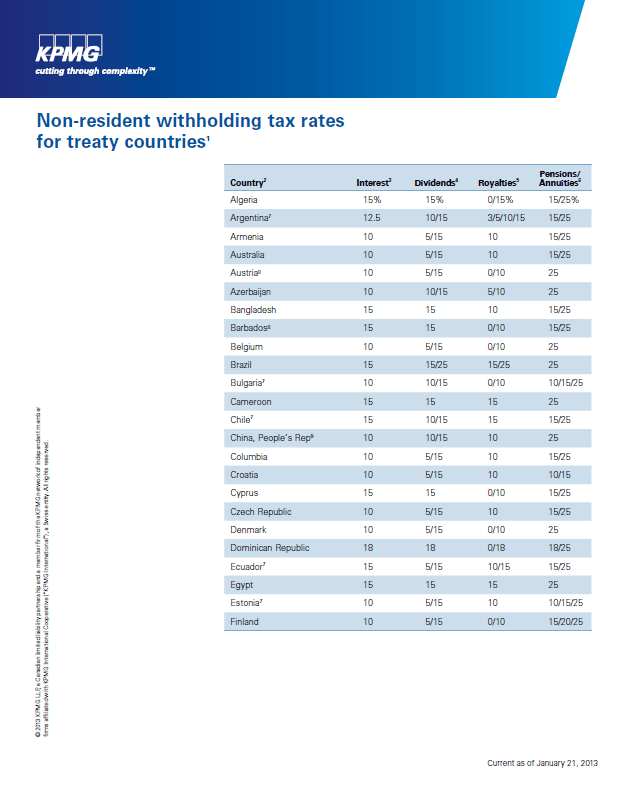

The withholding tax rates for interest, dividends, royalties and pensions/annuities earned held by foreigners from Canadian companies are listed in the attached document below. These applicable amounts based on the tax rates are withheld by the Canadian government. These rates are defined in the tax treaties in effect between Canada and the specific country. So if you are a British citizen and invested in a Canadian company you can use the table below to determine the appropriate rates.

Click on image to download (in pdf)

Source: KPMG

The Canadian withholding tax rate for dividends for individuals of most countries is 15% although there are exceptions. For instance, citizens of Turkey are charged a higher rate of 20%. Canada does not withhold taxes on dividends received by U.S. residents in qualified retirement accounts.

The standard Canadian withholding taxes on dividends is 25%. But due to the tax treaty between the Canada and U.S. , U.S. residents are charged a reduced rate of 15% by Canada.