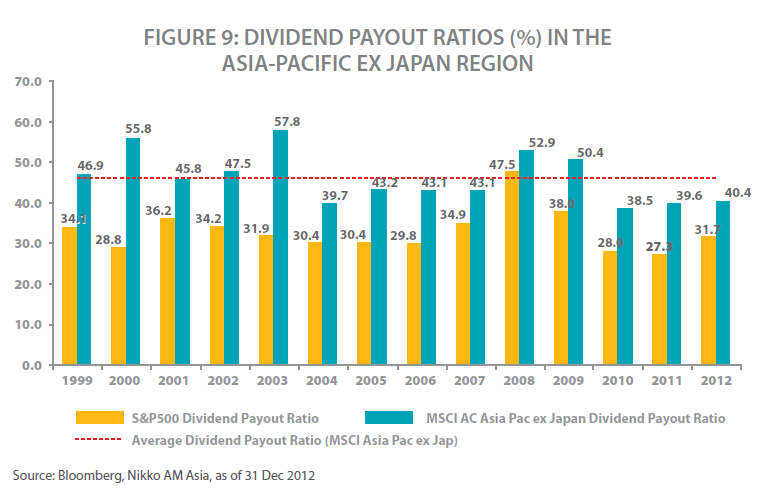

Dividend payout ratios are higher in the Asia-Pacific(excluding Japan) region than in the U.S. Historically Asian firms have paid out more in dividends than their U.S. peers.

The graph below shows the dividend payout ratio in the Asia Pacific region and the S&P 500 by year:

Click to enlarge

Source: High Dividend Investing – East Side Story, Nikko Asset Management, Singapore

Every year since 1999 the dividend ratio in the Asia-Pacific region is higher than in the U.S. In addition, the dividend per share (DPS) has been growing at an annualized rate of 8% in the Asia-pacific region compared to 5% for the S&P 500 firms.

Related ETFs:

Disclosure: No Positions