European equities have performed well so far this year with most of the major benchmark indices up by double digit percentages similar to the S&P 500. Despite the run up European stocks have more room to grow as most of the economies recover and years of sovereign debt crisis issues are well behind us and not ahead of us. As I have noted in previous articles, European stocks have plenty of room to catch with their American peers. So it is not too late to invest in European companies. Market experts at Charles Schwab emphasized this point in a recent article.

Despite problems, we believe there is an investment case for Europe. Many of Europe’s companies are global, reporting sales in both euros and local currencies. Many of these companies have strong competitive positions in the luxury, technology and industrials industries.

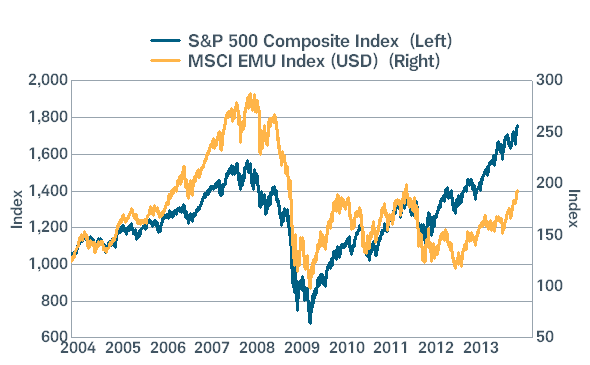

European stocks have room to catch up

Depressed profit margins also contribute to our positive outlook on European stocks. While profit margins in the United States have risen to a 45-year high, margins in the eurozone have declined since the beginning of 2008. If a modest economic recovery continues as we expect, we believe profits could post even higher growth, and help narrow the performance gap between US stocks and European stocks.

Source: Schwab Market Perspective: The Way Things Are…, Charles Schwab

Ten European companies are listed below for further research:

1.Company: Siemens AG (SI)

Current Dividend Yield: 2.31%

Sector: Industrial Conglomerates

Country: Germany

2.Company:D iageo PLC (DEO)

Current Dividend Yield: 2.36%

Sector:Beverages

Country: UK

3.Company:Technip (TKPPY)

Current Dividend Yield: 1.49%

Sector:Energy Equipment & Services

Country: France

4.Company: Aegon NV (AEG)

Current Dividend Yield: 3.11%

Sector: Insurance

Country: The Netherlands

5.Company: Edp Energias De Portugal SA (EDPFY)

Current Dividend Yield: 4.22%

Sector: Electric Utilities

Country: Portugal

6.Company:Air Liquide (AIQUY)

Current Dividend Yield: 2.40%

Sector: Chemicals

Country: France

7.Company: Lafarge SA (LFRGY)

Current Dividend Yield: 1.86%

Sector:Construction Materials

Country: France

8.Company: Danone SA (DANOY)

Current Dividend Yield: 2.57%

Sector:Food Products

Country: France

9.Company: Eni SpA (E)

Current Dividend : 5.83%

Sector:Oil, Gas & Consumable Fuels

Country: Italy

10.Company: National Grid PLC (NGG)

Current Dividend Yield: 5.03%

Sector: Multi-Utilities

Country: UK

Note: Dividend yields noted are as of Nov 4, 2013. Data is known to be accurate from sources used.Please use your own due diligence before making any investment decisions.

Disclosure: Long TKPPY