Puerto Rico-based Doral Financial (DRL) used to be a hi-flyer primarily due to sub-prime mortgage lending before the financial crisis. As the stock continued to plunge and headed towards $0.00 the bank implemented a reverse split on August 20, 2007 in the ratio of 1:20 when the stock reached a low of $0.54 a share.

The 2007 reverse split did not help stabilize the stock and it continued its downward decent soon after. In February of this year Doral reached a low of $0.53 a share again. The management instituted a second reverse split in the same ratio of 1:20 in July bringing back the share price above $17.00. Today Doral closed at $17.26. It will be interesting to see how long it takes Doral to go below $1.00 per share again.

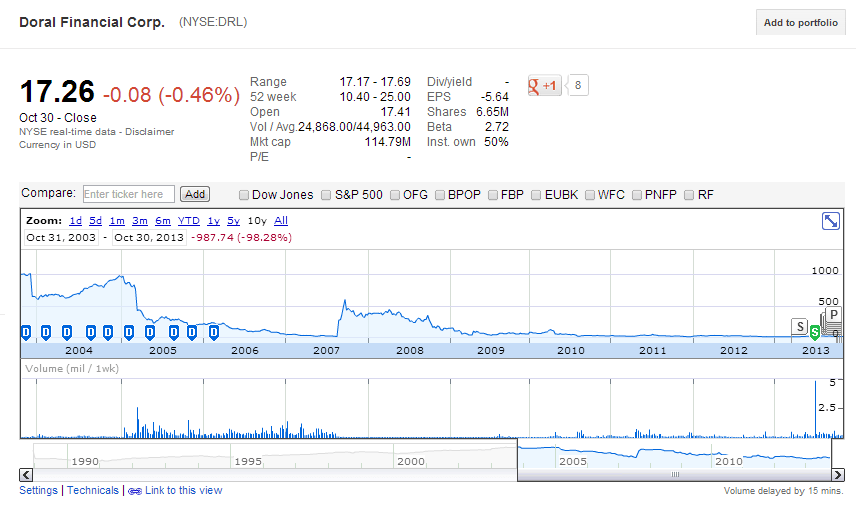

The following ten-year returns chart shows the disaster that is Doral Financial Corporation:

Click to enlarge

Source: Google Finance

Disclosure: No Positions