The correlation between a country’s economic growth and equity market returns is very low especially in the long-run. Many studies have confirmed that high economic growth does not translate into high equity returns for investors. For example, developed equities have yielded higher returns than emerging equities in the past few years despite the lower economic growth in the developed world than emerging countries.

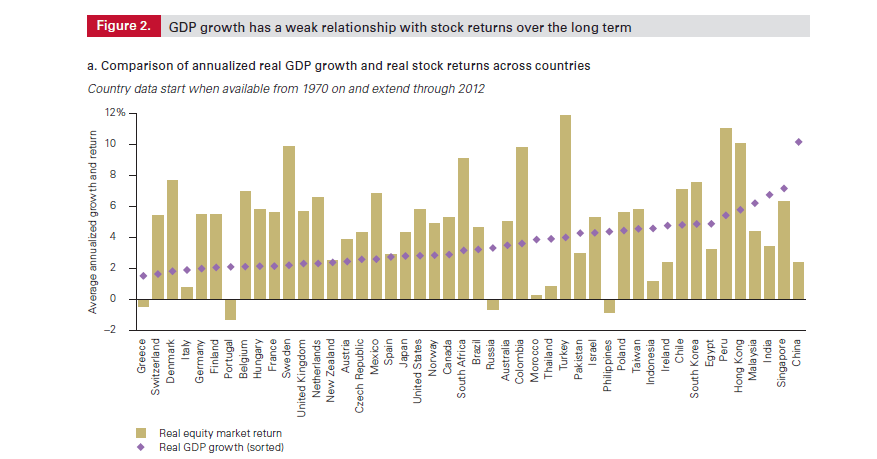

A recent research report published by Vanguard showed that there is a weak correaltion between long-run equity market returns to their economic growth (as measured by real GDP growth) across 46 countries.

Click to enlarge

Source: The outlook for emerging market stocks in a lower-growth world, September, 2013 Vanguard Group

From the report:

At 4.0% per year, the average real equity market return for the countries with the three highest GDP growth rates was slightly below the 4.2% average return for the countries with the three lowest GDP growth rates, despite the considerable difference in those rates (8.0% a year versus 1.6%, on average). It is clear that the correlation between these two variables is weak.

China is a classic case validating the above theory. Though China has the highest Real GDP Growth for the period shown above, the real equity market return has been lower. On the other hand, Germany has had a Real GDP Growth of about 2% but German stocks performed much better yielding over 5%.

Similar to Germany, equity returns are higher than economic growth for the U.S. also. In general it can be argued that developed countries can never have the same type of economic growth as emerging countries since they are already developed. For instance, basic infrastructure such as roads, bridges, ports, railroads, etc. already exist in the developed world while in many emerging countries they are being built only now. However developed countries offer many advantages like political stability, currency stability, transparency, lack of corruption, strong legal system, etc. Most emerging markets do not have these features. Hence investors are willing to pay a premium for developed equities even with a lower economic growth than emerging countries.

China’s Central bank projects the GDP growth to exceed 7.5% this year. The Federal Reserve forecasts the U.S. economic growth between only 2% and 2.3% this year. But in terms of stock market returns the S&P 500 is up over 19% year-to-date as of Oct 15th compared to -1.6% for the Shanghai Composite Index.

The main point that investors should remember is simply investing in equities because of high economic growth in a country would not necessarily mean higher returns.

Related ETFs:

- iShares MSCI Emerging Markets Indx (EEM)

- Vanguard Emerging Markets ETF (VWO)

- SPDR S&P 500 ETF (SPY)

- iShares MSCI Brazil Index (EWZ)

- iShares FTSE/Xinhua China 25 Index Fund (FXI)

Disclosure: No Positions