One of the defining characteristics of Capitalism is competition. Indeed competition in capitalist countries such as the U.S. is so fierce that thousands of companies go out of business every year since they can’t compete effectively.However it should be noted that “real” competition does not exist in all industries with some dominated by oligopolies or even monopolies. In industries where competition does exist, winners and losers are sorted out by the market.

Firms that have a competitive edge over their rivals thrive in the marketplace and can exist for a very long time. Public companies that fall into this category can produce substantial returns for investors as they are able to capitalize on their competitive advantage. If one or more competitors can copy their ideas or make better products then then the company that had the competitive edge loses that advantage quickly. For example, in the cell phone manufacturing industry, US-based Apple Inc(AAPL) was on top of the world last year due to the explosive popularity of its iPhones and other products. Investors couldn’t get enough of Apple’s stock pushing it well over $700 per share late last year. However mesmerized by the media and hyped by Wall Street they failed to realize that Apple’s competitive advantage is not permanent. Indeed their main advantage was not in the making of the iPhone (hardware) but the software that went into it that made operating the device incredibly easy for a kid, grandma or an adult. Other players in the industry were not going to sit around and let Apple dominate the industry far too long. Companies such as South Korea’s Samsung Electronics went on the offensive by offering cheaper and even better versions of mobile phones taking a sizable chunk of Apple’s market share in a short period of time. Accordingly Apple’s stock price has returned to earth and closed at $449.73 yesterday.

Companies that have multiple and sustainable competitive advantages can offer great returns to shareholders. This includes holding onto to a competitive idea or an advantage over a long time and not lose it like Apple. I recently came across a fascinating article by Ruan Stander, a quantitative and equity analyst and portfolio manager of Allan Gray Proprietary Limited of South Africa.

From the article:

Evidence for sustainable advantages requires a company that has:

1. Been around for a long time.

2. Outperformed the average company consistently.

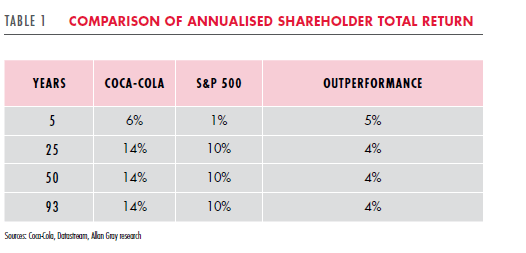

3. Not changed a lot over time to distort the analysis.One company that fits the profile is Coca-Cola. The company has been around for 126 years and has faced capitalism’s creative destruction for long enough to be counted as a fair example. Table 1 on page 7 illustrates how Coca-Cola has been able to generate value for shareholders over the short, medium and long term beyond the market average. If an investment in the market in 1919 was worth R1m today, an equal investment in Coca-Cola would be worth R37m.

Click to enlarge

Note: The investment return amounts noted are in South African Rand (R).

He discussed three competitive advantages that companies such as Coca-Cola hold:

1. Significant benefits to scale (an industry in which being bigger helps to keep costs low).

2. A leading market share (capturing the benefits of [1]).

3. A supply chain that is superior and hard to copy for existing competitors.A supply chain that is superior and hard to copy for competitors with a reasonable market share

The third point is important since it is the ‘moat’ that turns 1) and 2) into a money-making machine for shareholders. For Coca-Cola the advantages are a bottling and distribution system that is hard to replicate and a recipe that is widely regarded as one of the best kept secrets in business.

Source: Buy OUTsurance, Quarterly Commentary, March 2013, Allan Gray

Nine other U.S. companies that have sustainable competitive advantages are listed below for further research:

I believe most of these companies hold all the three sustainable advantages discussed by Ruan above using Coca-Cola as an example. However I have not validated them. But they satisfy at least the criteria that they have been around for a long time.

1.Company:Colgate-Palmolive Co. (CL)

Current Dividend Yield: 2.22%

Sector:Household Products

In business since 1806, the company owns globally popular brands such as Colgate toothpaste, toothbrushes, Palmolive dishwashing liquid and many others in the household products category. In the time period from 12/31/2092 to 3/31/13, the company’s stock yielded a total return of 1169% compared to just 437% for the S&P 500 and 765% for the peer group which includes The Clorox Company (CLX), Avon products (AVP), Kimberly-Clark (KMB), Procter & Gamble (PG), Unilever NV and plc (UN, UL) and Reckitt Benckiser Group plc(RBGLY).

2.Company:Procter & Gamble Co. (PG)

Current Dividend Yield: 2.94%

Sector:Household Products

P&G gets 62% of its sales from emerging markets. Some of the company’s products include items such as toothbrush, toothpaste, paper towels. etc. P&G hasn’t changed much from manufacturing and selling these and other household products since 1837.

3.Company:International Business Machines Corporation (IBM)

Current Dividend Yield: 1.85%

Sector:IT Services

Founded in 1911, IBM is now more of a IT contract services provider than an innovator of new technologies. Capitalizing on its coveted patents and core competencies the company continues to thrive and earned $104.5 billion in revenues last year.

4.Company: Lorillard Tobacco Company (LO)

Current Dividend Yield: 5.01%

Sector:Tobacco

According to the company website, Lorillard is the oldest publicly traded company listed on the New York Stock Exchange and one of the oldest continually operating companies in America. Lorillard celebrated its 250th Anniversary in 2010. Founded in 1760, it is the third largest cigarette maker in the U.S..

5.Company:Exxon Mobil Corporation (XOM)

Current Dividend Yield: 2.75%

Sector: Oil, Gas & Consumable Fuels

Originally founded in 1870, the company today is the world’s largest publicly traded oil and gas company.

6.Company:Johnson & Johnson (JNJ)

Current Dividend Yield: 3.04%

Sector:Pharmaceuticals

Founded in 1886, Johnson & Johnson went public in 1944. J&J has increased dividends for 51 consecutive years.

7.Company:Abbott Laboratories (ABT)

Current Dividend Yield: 1.48%

Sector:Pharmaceuticals

As a major drug company Abbott manufactures many products in the areas of diabetes care, cardiac and vascular diseases, eye care, nutrition solutions, etc. Companies in this sector naturally have an edge over competitors since they hold the patents for the drugs they invented.

8.Company: Lockheed Martin Corporation (LMT)

Current Dividend Yield: 4.30%

Sector:Aerospace & Defense

Lockheed Martin’s history dates back to 1909. The company is a world leader in the aerospace and defense sector with thousands of innovations that are patented.

9.Company:Norfolk Southern Corp (NSC)

Current Dividend Yield: 2.58%

Sector:Road & Rail

Dating back to 1883, Norfolk Southern hasn’t changed much in a very long time other than many mergers and acquisitions. Today it operates about 20,000 route miles in 22 states and DC serving every major container port in the eastern U.S.

Data Sources:

Public companies 100 years old or more, USA Today

Company Sites

Note: Dividend yields noted are as of May 31, 2013. Data is known to be accurate from sources used.Please use your own due diligence before making any investment decisions.

Disclosure: Long NSC, RBGLY