One of the dilemmas often faced by investors in dividend-paying stocks is if they should reinvest the dividends or not. Reinvesting dividends received from equity investments on a periodic basis such as monthly, quarterly, bi-annually or even annually can substantially boost the total returns earned, especially in the long-term due to the effect of compounding.

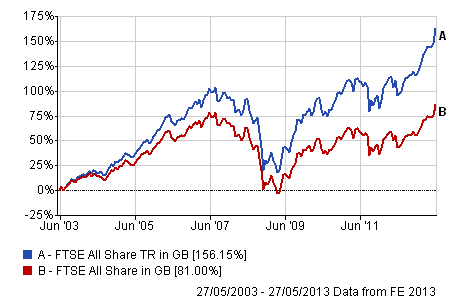

The following chart shows the performance of the FTSE All Index of UK with and without dividend reinvested over the past 10 years:

Click to enlarge

Source: Reinvesting dividends key for growth, says Franklin Templeton’s Morton. FE Trustnet

Note: The blue line shows the Total Return (TR). The returns shown are in British currency terms.

From the article:

Investors who had simply put their money in the FTSE All Share would have seen their money grow by 81 per cent over the last decade, according to data from FE Analytics, but those who had reinvested their dividends over that period would have made 156.15 per cent.

Reinvesting dividends in the FTSE All Share index almost doubled the return for the period noted.

The decision to reinvest dividends depends on many factors like the goal of investment, type of investor, market conditions and so forth. Like any other investment concept, dividend reinvestment also has both advantages and disadvantages.

Some of the pros of dividend reinvesting include:

- Dividend reinvesting takes the worry of trying to figure out where to invest the dividend amounts received every time.

- The automatic reinvestment of dividends option offered by most brokers can make the reinvestment process easy and systematic.

- Most brokers reinvest the dividends for free without any commissions thus helping an investor acquire new shares without costs.

- In declining and volatile markets, an investor can pick more shares cheaper by reinvesting dividends.

- Dividend-payers that consistently increase dividends can help to accumulate additional shares when held over many years thereby increasing the total returns.

Some of the cons of dividend reinvesting include:

- This strategy deprives an investor of the ability to invest in some other stock or asset which may higher potential for growth.

- Reinvesting dividends in low quality companies or some sectors may not yield the best result. For example, it is not a wise idea to reinvest dividends in tech stocks since not only are the yields low but companies in the sector can go out of favor or even out of business almost overnight due to changes in the unpredictable industry.

- Taxes have to be paid in the years when dividends are earned from stocks held in taxable accounts. If a crisis such as the global financial crisis erupts and the company’s stock becomes worthless, an investor not only lose the original investment but also all the dividends earned and the taxes paid.

- Dividend payments are discretionary and can be cut for any or no reason by a company. When this happens, investors are likely to dump the stock wiping out years of price growth. An investor who was loyal to the company and reinvested every cent of dividend for years will lose out on gains.Hence selecting high-quality well established companies is important.

- If a broker charges a commission to reinvest dividends then reinvesting dividends will not be highly beneficial.

Despite the cons noted above, dividend reinvestment can be an excellent tool to build long-term wealth. However instead of blindly plowing back the dividends into their current holdings, investors have to be selective in picking companies for dividend reinvestment.

Ten British stocks that investors can consider for long-term investment are listed below with their current dividend yields:

1.Company: Unilever PLC (UL)

Current Dividend Yield: 2.97%

Sector: Food Products

2.Company: British American Tobacco PLC (BTI)

Current Dividend Yield: 3.78%

Sector:Tobacco

3.Company: Vodafone Group PLC (VOD)

Current Dividend Yield: 5.19%

Sector: Telecom

4.Company: HSBC Holdings PLC (HBC)

Current Dividend Yield: 4.16%

Sector: Banking

5..Company: Imperial Tobacco Group PLC (ITYBY)

Current Dividend Yield: 4.60%

Sector: Tobacco

6.Company: AstraZeneca PLC (AZN)

Current Dividend Yield: 5.37%

Sector: Pharmaceuticals

7.Company: Legal & General Group PLC (LGGNY)

Current Dividend Yield: 3.80%

Sector: Financial Services

8.Company: Reed Elsevier PLC (RUK)

Current Dividend Yield: 2.08%

Sector: Media

9.Company: GlaxoSmithKline PLC (GSK)

Current Dividend Yield: 4.51%

Sector: Pharmaceuticals

10.Company: Diageo PLC (DEO)

Current Dividend Yield: 2.31%

Sector: Beverages

Note: Dividend yields noted are as of May 30, 2013. Data is known to be accurate from sources used.Please use your own due diligence before making any investment decisions.

Disclosure: Long LGGNY