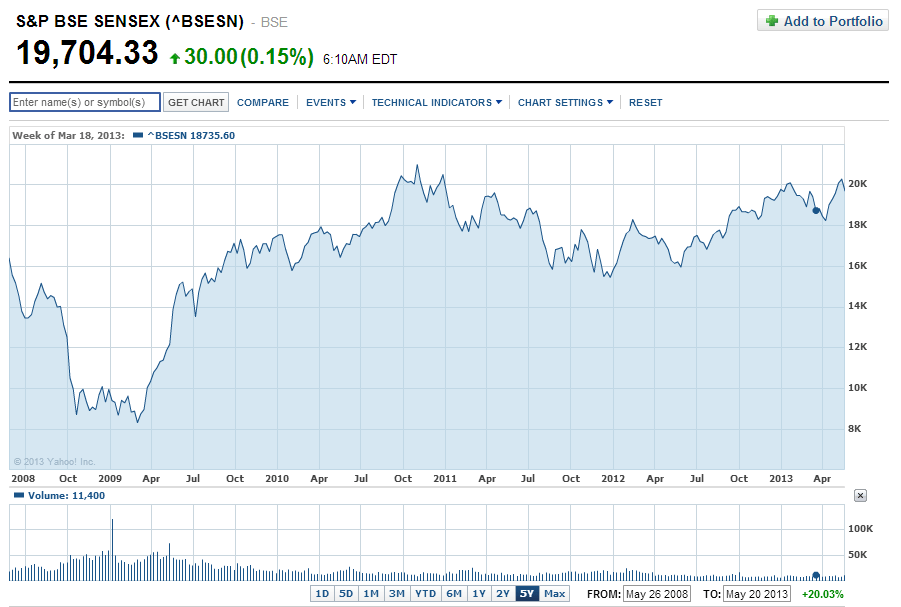

The equity market in India as represented by the benchmark Sensex is up 1.40% YTD. In the past year, the index has had a strong run going from over 16,000 to 20,443 this year before closing at 19,704 last Friday. The Sensex has more than doubled from the lows reached in early 2009 at the height of the global financial crisis as shown in the chart below:

Click to enlarge

Source: Yahoo Finance

Despite the solid performance the equity market, most Indians seem to avoid the stock market and instead invest in other assets. For example, the number of retail mutual fund accounts has declined by 4.25 million in the first 11 months of the fiscal year 2012-13 according to one report. This does not mean 4.25 million individual investors since one investor can hold multiple accounts.

Much of the rally in Indian stocks especially this year can be attributed to foreign investors who have pumped billions into the market while domestic investors have been mostly pulling their investments in stocks. Unlike other emerging countries such as Brazil where foreign investors have reduced their exposure in the past few years, India has become a hot destination for foreign investors.

From a story in the Journal earlier this month:

From January to March, foreign institutional investors’ ownership of India’s top 500 stocks rose at the fastest quarterly pace ever, according to Citigroup C -0.02% . Collectively, their stake of 21.1% hit an all-time high, and investors outside the country now own more of India Inc. than those within. Ultralow interest rates in the West helped push foreign inflows to $10 billion in the period, the second highest in any quarter.

Yet Mumbai’s stock market fell 3%. Even as foreigners were buying, the locals were selling: Domestic institutions like mutual funds sold off $6 billion. India’s low growth and high inflation have drained their enthusiasm for stocks.

It is interesting to analyze why foreign investors rushing into Indian equities while domestic investors are ignoring them.

Here are five reasons why domestic investors tend to avoid stocks:

1. Banks pay high interest rates for many types of accounts making them more attractive to high-risk assets such as stocks. For example, one can easily find banks offering 9.00% interest on a 1-year CD. Hence most people don’t bother with investing in stocks since they have not yielded astonishing annual returns since the financial crisis of 2009.

2. Traditionally Indians are highly conservative and this is reflected in the low stock market participation rate. India has one of the lowest stock market participation rate in the world at less than 3.50% according to one study. For a country with a population of over 1.2 billion this is indeed very low. Despite the tremendous growth of Indian equity markets in the past decade, the general population still considers equity investments to be highly risky.

3. Indians consider gold as “safe” investment compared to stocks. Hence India remains the largest importer of gold in the world. The demand for gold rose from 679 tonnes in 2008 to 975 tonnes in 2011 despite higher gold prices before the crash in gold prices. Demand has picked up again as lower prices attract buyers. Though gold does not provide an income like stocks do with dividends, the demand for gold continues to be high since they are regarded as a store of wealth, used as jewelry , offered in weddings, etc.

4. The real estate sector is growing rapidly and prices seem to head for the stratosphere year after year. Unlike some other countries, real estate prices did not plummet due to the financial crisis and in fact continues to remain strong. As a result, more domestic investors are attracted to the real estate market than the equity market. In addition, most companies have low dividend payouts making their stocks unattractive to income investors whereas an investment in real estate can generate a better yield.

5. Saving for retirement by investing in stocks is not widely popular phenomenon. Most workers save for retirement in a fund known as Employee Provident Fund (EPF) that pays an interest of of 8.70% and is regulated by the state. Hence most of the retirement savings do not flow into the equity market. This is in sharp contrast to other countries such as the U.S. where most workers save for retirement by investing in stocks and bonds.

Related ETFs:

WisdomTree India Earnings (EPI)

iShares S&P India Nifty 50 Index (INDY)

PowerShares India (PIN)

Disclosure: No Positions